Value Stream Management (VSM) is a powerful approach to improving business processes and enhancing customer satisfaction. It focuses on identifying the value stream, or sequence of activities that add value to the customer and eliminating waste in that stream. VSM principles can help streamline processes, reducing inefficiencies and minimizing costs while improving customer satisfaction.

In this blog, we will explore VSM in action with a bank applying VSM to its loan process as an example of how this approach can benefit both the bank—or your business—and its customers.

Concepts we will refer to in this blog include Value, or the benefits received, and the importance of it being measurable and requiring continuous validation. Next, the Value Stream, that encompasses the activities that comprise the process of delivering a product or service and generate value. This includes all the people, systems and flow of information needed to deliver the product or service, and there can be one or many value streams. Finally, Value Stream Management, which is the framework and process of analyzing and improving value streams to maximize efficiencies and minimize waste in the value streams.

To clarify what value stream management means in the context of a modern-day organization and its business operations, we’ve simplified an example of a bank and how it provides loans to its customers. We all interact with our banks in so many ways and think about the experience and services you receive--or don’t receive--from various channels of a bank. These are all driven by a value stream that enables the service provided by the bank. The concepts we defined above are experienced this way for the bank’s customers.

- Value from a customer’s standpoint could be the ease with which they can obtain a loan from the bank based on their needs. It could be measured in terms of customer satisfaction scores, the time it takes them to go through the process, ease of going through the process, simplicity of the process, and so on.

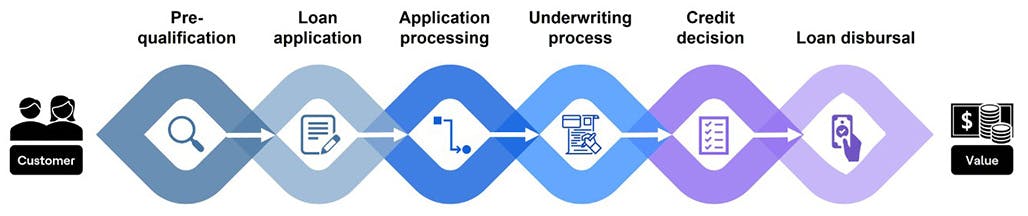

- Value stream could be the process of delivering a loan to a customer, from the initial loan application to the disbursement of funds. For the sake of simplicity, assume that this process involves the following stages.

As you can see, a value stream is comprised of various stages or activities in sequence, with people involved in all those stages and with systems supporting each stage.

Value Stream Management (VSM) in action.

The bank in our hypothetical example realizes that their CSAT scores for loan processing are lower than the industry average and the management has decided to improve it. Here is how VSM can assist the bank.

- Value stream identification

- Value stream mapping: The bank creates a visual representation of all the systems/sub-systems, processes, people involved in this value stream.

- Identify areas of improvement: Using the value stream map, the bank identifies these issues.

- It takes a lot of time for the customer to fill out the loan application form, and this excessive time leads to poor customer satisfaction.

- The data process team relies on outdated tools to perform various checks, leading to increased cycle time.

- The loan authorization team must go through a lot of data points to arrive at a final decision, which also has an impact on the cycle time and quality of decisions made.

- Implement improvements: Based on these challenges, the bank has decided to implement the following changes to optimize the value stream.

- Pre-fill as many data points in the loan application form from the pre-qualification documents so that the customer just validates the data and submits the form.

- Modernize the tools used by data processing team by upgrading to the latest versions and adopting newer features in those tools. This should help the team in automating a lot of data processing tasks.

- Leverage AI & ML to generate intelligent insights in areas of fraud analytics, credit worthiness and other important considerations to help the authorization team make better and faster decisions.

- Continuously monitor: Once the bank opts to implement the changes, they periodically measure the effectiveness of its changes on the flow of value and on customer satisfaction. In this process, it could identify newer areas of improvement or existing changes that are not resulting in any benefits.

In this example, a bank could improve efficiency, reduce costs, and provide a better customer experience by applying value stream management approach to its loan process. Ultimately, this could help the bank to remain competitive and attract more customers.

Value streams exist in many forms across organizations in all industries. They can be one or two seamless streams covering everything, top-to-bottom. Or it can be many different streams at many different levels. Most organizations will typically have a hierarchy of value streams where each child value stream could be enabling or adding value to the parent value stream. There may be many different sub streams of value in an organization that may or may not be tied to each other in a systemic way. As an organization becomes more adept with the principles of VSM in action, it becomes more adept at identifying value streams.

In our upcoming series on VSM, we will delve deeper into a simple perspective on how value streams exist in a typical organization, and explore them in the context of value, work, and organization levels. Whether the organization is in banking as in our example or another sector, the principles remain the same.

For more information, visit Enterprise Studio.