Introduction

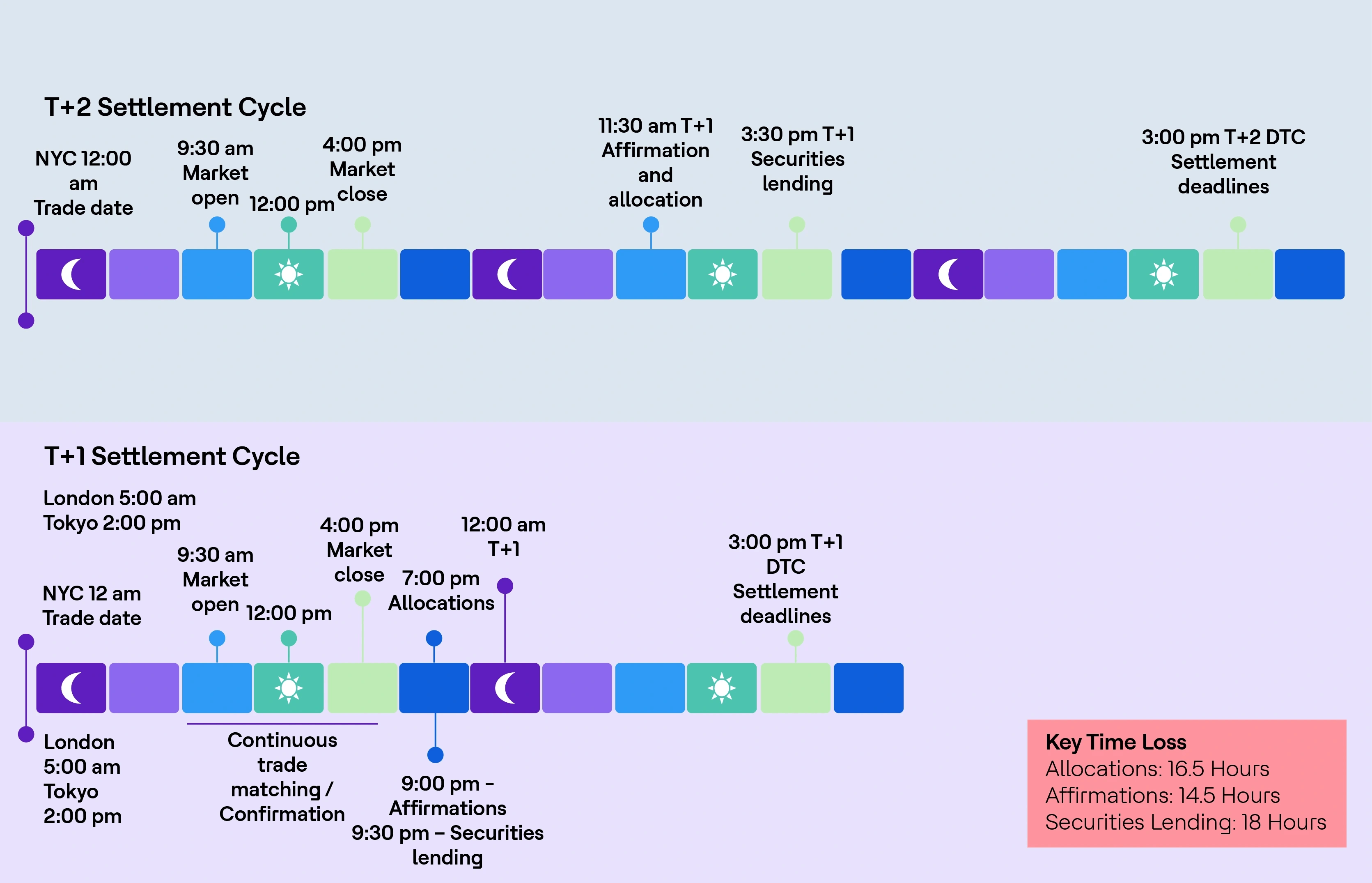

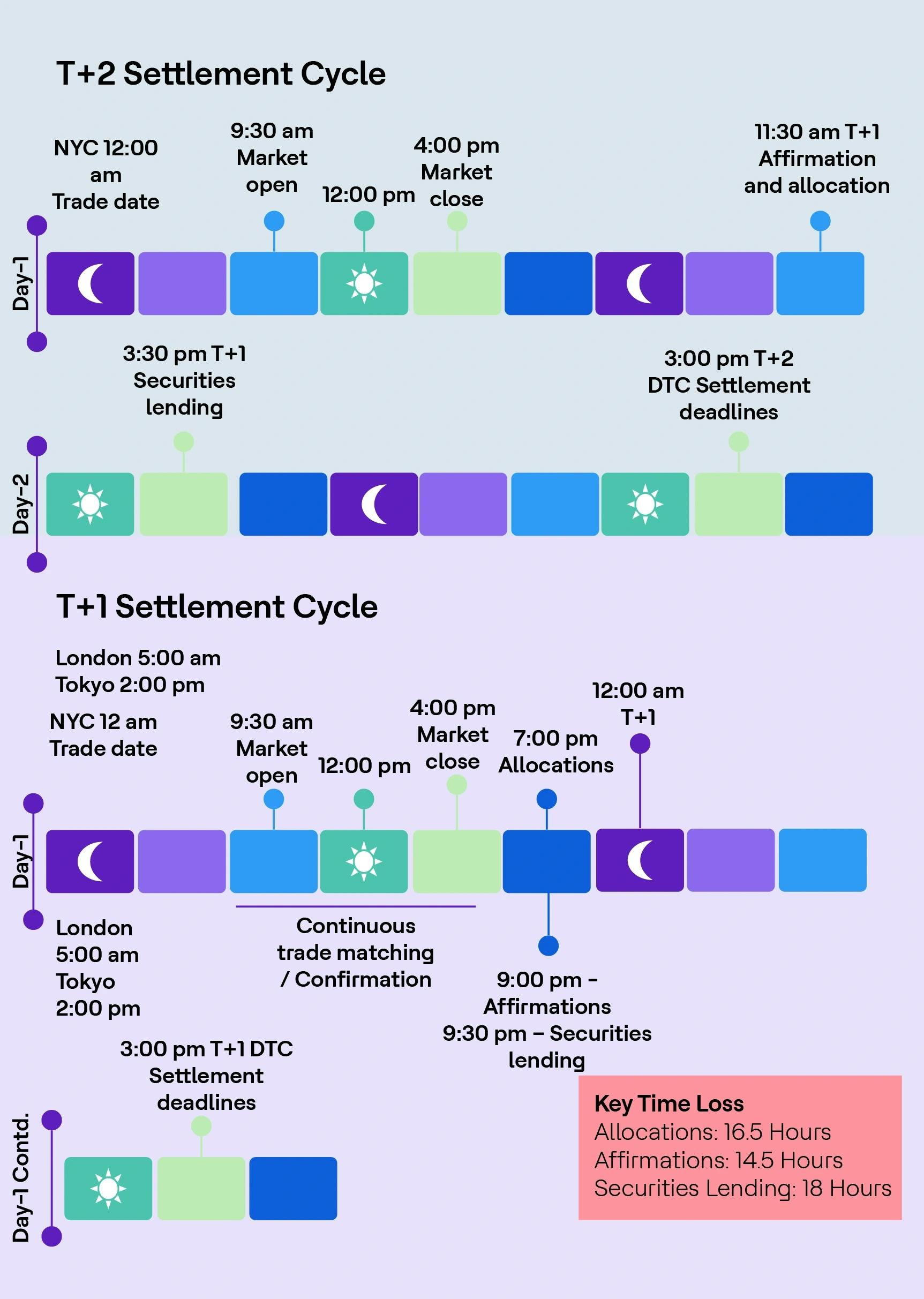

It's been just over six months since the US market witnessed one of the biggest changes in the trade settlement process. The new T+1 settlement cycle, which went into effect on May 28, 2024, has shortened the previous T+2 cycle. This means the time required for firms to process the trades has been reduced by 24 hours, leaving much less time to process and resolve issues for successful trade settlement and meet all the regulatory requirements.

Many firms have heavily invested in upgrading their trading and post-trade systems to handle faster settlement deadlines. While many U.S. firms are largely equipped to handle the T+1 settlement cycle, despite the initial stats suggesting improvement in affirmation rates and fail rates consistent with the T+2 settlement cycle, several challenges remain that could lead to settlement delays or failures. These challenges are primarily related to operational and technological adjustments. Even though the failed trade numbers have not increased per initial data, process adjustments have stressed middle and back-office operations teams.

Let's explore what possible approaches will make their process more seamless and resilient to eliminate existing challenges handling T+1 and be ready to handle future contingencies.

New landscape

The new business process landscape has several changes, but the key point is that firms are compelled to function on a more real-time/intraday basis as opposed to EOD, typically done in a T+2 settlement cycle.

Depository Trust and Clearing Corporation (DTCC) has laid down the suggested operating model and playbook extremely well for the firms to follow and helped firms to successfully transition into the T+1 cycle on day one. The processes that need the maximum attention to align with the new transaction timeline are:

| Process | Shortened time compared to T+2 |

|---|---|

| Trade allocation | 16.5 Hrs. |

| Trade affirmation | 14.5 Hrs. |

| Securities lending | 18 Hrs. |

Migrating towards T+1 settlement cycle

Benefits and opportunities

Though Financial Institutions (FIs) are largely equipped to handle the T+1 settlement cycle, several internal challenges could lead to settlement delays or failures. The table below provides the data for the first 3 months, suggesting a seamless transition for FIs and market participants. While some firms have overhauled their IT landscape, many managed with tactical solutions, adding a lot of additional load and responsibility on middle and back-office operations.

Another aspect firms are looking for is to make their systems and processes more stable to handle global markets, which are also planned to move to the T+1 cycle in the years to come. Europe is already following the path of the US and is in the process of implementing T+1.

Lastly, firms should start working towards a strategic scalable solution because discussions about the T0 settlement cycle are already underway. Though it's premature to assess the required changes as it would be a much larger infrastructure overhaul compared to migrating from T+2 to T+1, firms should begin focusing on key foundational aspects to make their business and IT processes scalable and resilient.

The move to T+1 was successful, as demonstrated by various metrics

Initial stats (Jun-Aug’24) post T+1 implementation in the US market :

| Process | T+1 stats | T+2 stats |

|---|---|---|

| On-time Trade Affirmation | 95% | 73% |

| Fail trade settlement | CNS – 1.9% Non CNS- 2.92% | CNS-2.1% Non CNS- 3.24% |

Suggested solution for post-trade processing

Below are some of the key solution approaches firms should be looking at as a checklist to make the process more scalable and resilient:

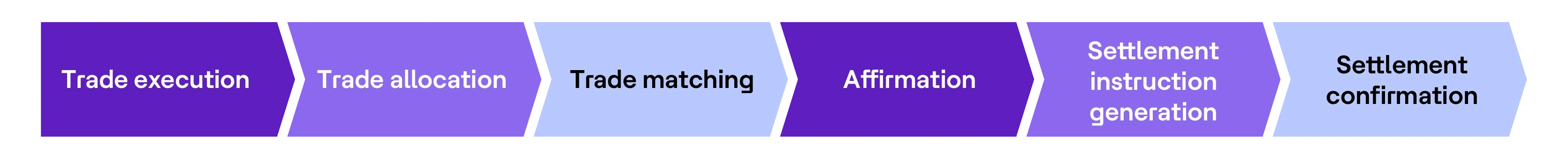

Full stack value stream-based observability and real-time monitoring for effective production support

Considering trade processing from trade execution through settlement is a sequential time-sensitive process, it is critical to have a centralized view of trade status and lineage for traceability. It's also important to identify the source and possible cause of the issue in real time to resolve the issue faster. The issue could be at APIs, data, applications, IAM, infra capacity, etc., and must be tracked down much faster than before.

Trade processing value stream example

Implementing value stream-based full-stack observability is the way forward for end-to-end business process visibility, providing a few key benefits:

- Help move from reactive to proactive identification of the issue

- Value stream-based observability will map and observe performance against business service level indicators (SLO/SLIs)

- Reducing mean time to resolve (MTTR) through early detection of the issue and its possible source.

- Create an ecosystem for real-time monitoring of applications, resources, IAM, and data to improve traceability across the value chain.

- Predictive analytics to forecast potential system slowdowns based on current trading volumes or system load, alerting the support team before issues impact settlements.

Real-time data integration APIs and straight-through processing (STP)

Most large firms have created a network of applications across front-to-back offices over decades, and many legacy applications may not talk to each other in automated ways or transmit data through FTP. As a diverse business function between front and back offices, most FIs use best-of-breed COTS or in-house developed applications. This adds complexity to data synchronization across applications.

FIs need to complete an assessment of their system landscape and see the opportunity for APIs for straight-through processing to eliminate error-prone and time-consuming manual processes. Using real-time APIs to integrate front-office, middle, and back-office systems will ensure that trade data flows seamlessly and instantaneously between systems and avoid settlement delays from exception handling and error-prone manual activities.

AI-powered operations

While every FI is exploring how best to utilize AI technology for optimal benefits, trade operations are certainly one of the best areas to implement AI/Gen AI. It can significantly improve the efficiency of T+1 settlement processes by automating communication, data management, and issue resolution. Below are some of the key use cases to get the immediate benefits:

AI-powered reconciliation

Trade reconciliation is another area that involves verifying data between multiple systems (front office, middle office, custodians) to ensure consistency. In a manual and rule-based reconciliation environment, the process is error-prone, and false alerts are major contributors to the operations team's longer processing time.

With a shorter window to resolve any data mismatch, it is important to automate trade reconciliation data load using robotic process automation (RPA) and straight-through processing (STP) to eliminate manual intervention.

Once the data is pulled from systems, AI-powered reconciliation will identify and correct common mismatches in real-time, reducing false alerts and saving the operations team analysis time to fix genuine mismatches.

Many new FinTechs provide AI-powered reconciliation tools that we work with, which can be implemented as standalone end-to-end reconciliation solutions or on top of traditional rule-based reconciliation tools. We have also built in-house solutions for several clients meeting their specific needs.

AI-based fail trade prediction for preemptive resolution

Low-volume yet high-value trade settlement fails daily, incurring financial penalties and reputation damage.

AI-powered predictive analysis tools can be implemented by learning failure patterns from historical trade data and performing predictive analysis for possible failures in open trades. This analysis will run throughout the day as soon as the trades are executed, alerting the operations team for investigation and follow-up to ensure timely resolution.

Many leading banks have implemented this working with IT vendors.

AI-powered chatbots

AI-powered chatbots should be considered another means to provide speed, enable query resolution, facilitate collaboration, and address client queries.

There are several use cases within chatbots, which can be implemented for internal teams and for client-facing which can reduce the time and effort from the operations team. Some examples of the use case are:

- Real-time trade status updates provide an instant response to a query on trade status

- Client support and query handling manage repetitive queries related to settlement details, reducing the operational burden on human teams.

Capacity planning and scalability

Considering the huge data volume flowing throughout the day and needing to be processed by several distributed teams, firms need to align with the organization's cloudification strategy and prioritize the migration of post-trade applications and data.

FIs need to conduct capacity analysis to determine whether their current infrastructure can handle peak trading volumes and help firms scale their systems appropriately. During periods of high market volatility (e.g., post-announcement of key economic data), trading volumes surge, which could overwhelm the FIs' existing IT infrastructure, leading to system outages or slow processing times.

Example of cloud scalability: By migrating key systems (e.g., trade execution, clearing, and reconciliation) to the cloud, FIs can dynamically scale resources (compute and storage) during high trading volume periods. This ensures systems perform under pressure, preventing settlement delays caused by system slowdowns or outages and ensuring that high trade volumes are processed efficiently within the T+1 timeframe.

Future outlook

Transiting from the T+2 to the T+1 settlement cycle should not be seen as a one-off event but rather as a journey for the financial market. As most large firms operate in both the US and global markets, markets have become more interconnected, increasing the need for greater efficiencies. The lessons learned from the U.S. market can be applied to European markets, where similar challenges will arise, particularly around automation and infrastructure

Discussions are already taking place in the market regarding the transition from T+1 to T0 settlement. FIs must work on internal process efficiencies and automation, which will help them not only cope with current T+1 challenges but also prepare them for T0. Implementing T0 will require much larger infrastructure changes for FIs and market participants, and it’s too premature to determine the specific changes needed.

For now, FIs should focus on automation and process efficiencies to manage the US T+1 and global market adoption of T+1.