The tectonic disruption we have experienced since the onset of the pandemic has induced significant transformation in every industry.

Financial inclusion is one such positive transformation that enhanced people's access to finance. The pandemic proved that financial needs are to be given equal importance as health needs to have a community strong enough to overcome such disruption. The objective of open banking is precisely to ease access to the financial ecosystem in addition to fostering innovation and healthy competition.

The healthy impact of open banking on the banking ecosystem has inspired similar ideas in other financial service sectors, such as wealth management and insurance, through OpenWealth API (Application Programming Interface) and OpenInsurance API, respectively.

As the pioneer industry that led this open transformation in the financial world, the banking ecosystem is now looking to roll out "Open Finance" into the orbit of financial offerings.

1.1 Open finance – context

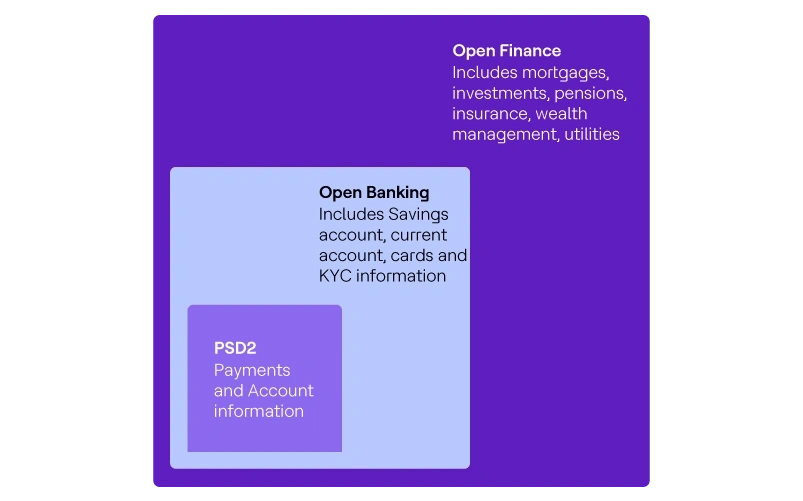

Open finance is the next step in the growth story of open banking transformation. It can be defined as the model for sharing customer data with and among financial services providers and other third-party providers, with the objective of enabling customer access to a wider range of products and financial services.

Equipped with knowledge of financial offerings, customers can diversify their personal finance structure. Upon maturity, open finance is expected to provide insight into the complete financial footprint of an individual benefitting both customers and business to identify opportunities. For a financial advisor, this would mean the ability to view a customer's investment, savings and cash flows in one place and placing the advisor in an ideal position to provide insightful financial advice and recommendations.

Industry regulators such as OBIE (Open Banking Implementation Entity) for the UK and The Berlin Group for the EU have streamlined open banking implementation in Europe. Although there is some momentum in this direction, it may take some time before a wider industry-wide consensus is achieved for open finance. The European Commission rolled out the Open Finance Framework in June 2023.

1.2 Open finance vs. open banking

The primary difference between open finance and open banking is in the scope of offerings. While open banking is focused on banking offerings, with emphasis on account aggregation and payment transactions in retail banking, open finance expands the scope to span across industries and include data from mortgage providers, consumer credit firms, investment and pension funds, general insurers, intermediaries, wealth management, healthcare providers, government agencies, utility companies, retail merchants and others. Open banking is, in a way, a subset of open finance.

1.3 The global initiatives on open finance and open banking

Aided by lessons learned from implementing open banking, regulatory bodies and institutions worldwide are consulting with industry partners to determine the best possible way to roll out open finance.

Europe, which is at the forefront, has rolled out the Finance Data Access (FIDA) framework, also known as the open finance framework, on June 2023. This framework is expected to support the implementation of open finance across the EU. The FIDA scope encompasses all customer data held in the financial sector. The EU is expected to implement an open finance framework by 2026.

In the UK, the Smart Data Initiative launched in October 2023, and the upcoming Data Protection and Digital Information Bill aims to improve cross-sector coordination. The framework outlines the benefits and use cases of cross-sector data sharing in banking, finance, communications and energy.

In Canada, the Canadian Advisory Committee and Department of Finance (Canada) want to ensure that a governance framework for open banking is in place by 2025.

In the U.S., open banking has been driven more by market demand rather than regulation. So far, Consumer Financial Protection Bureau (CFPB) is working on new rules to establish open banking solution.

1.4 Open finance drivers

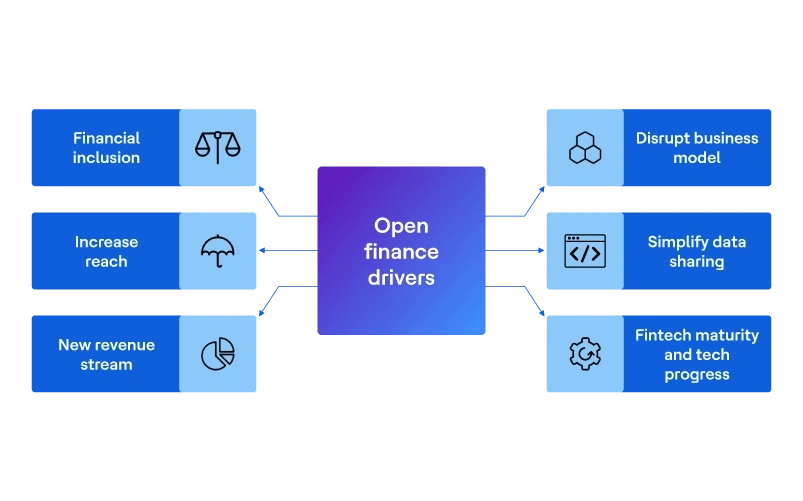

- The push for financial inclusion to enable a higher population to access financial offerings.

- Increase reach for both businesses and customers through new digital ways.

- Generating new revenue streams in partnership with financial service providers who offer products or services complementing the partnering institution's business vision.

- Opportunity to pilot new business models by bundling services.

- Simplify sharing of financial data, among financial services providers and third parties, by adhering to common construct and framework regulated by a responsive regulatory or industry body.

- Maturity of fintechs as an insightful partner fully aware of both the unexplored potentials and limitations of existing financial industry regulatory frameworks. Embedded finance is one such space that has benefitted immensely from fintech engagement.

- Technology advancements in cloud, blockchain, automation, AI and ML, etc.

1.5 Use cases supported by open finance

The targeted consultation paper, by the European Commission, on open finance framework and data sharing envisaged the following use cases related to financial services:

Use cases covering business-to-customer engagements:

- Comparison services that facilitate provider switching and discovery of new offerings that complement the products or services explored by the customer.

- Personalized advice and tailored financial products based on the customer’s data. Customers can allow an advisor to access their financial and non-financial history for better advisory services.

- Next-generation personal finance management services can enable customers to have a single view of all their financial details. The dashboard can alert customers about lower interest rate products, impending charges, bills or premiums and insurance cross-sell opportunities.

- Personal wealth management services to monitor and manage assets and liabilities. This encompasses financial goal management, analytics of investments and their returns, and monitoring of wealth management aspects such as savings, budgets and spend.

- Digital or mobile tools to assess the environmental sustainability and governance (ESG) profile of financial products (e.g., the environmental impact of investment portfolios or carbon footprint estimation of specific products).

- Pension tracking tools that provide a comprehensive overview of entitlements.

- Alternative credit scoring methods for financial inclusion (e.g., gig economy workers).

Use cases covering business-to-business engagements:

- Small and mid-sized financial institutions can partner with traditional institutions and offer financial products. Know your Customer (KYC) details can be leveraged to ease the customer onboarding process.

- Financial Institutions can offer embedded finance to other businesses, integrating their services with the business offerings. The Business from embedded finance is forecasted to $230B business by 2025.

Besides financial use cases, the following non-financial use cases are being explored:

- Sharing in-vehicle data to predict maintenance work and personalize motor insurance.

- Peer to peer lending leveraging bank account and payment facility.

- Embed payment facility for ecommerce websites.

- Digital account setup for firms that require more than a customer email ID and contact number due to KYC guidelines.

1.6 Challenges ahead on the road for open finance

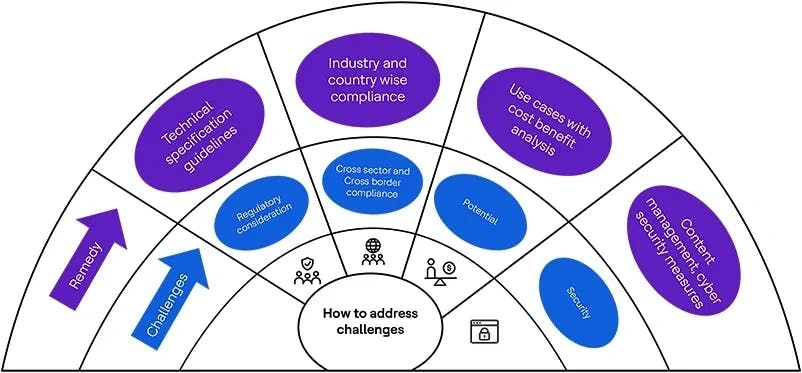

Regulatory considerations

Any cross-sector data sharing would have to be consistent with other cross-sector regulatory initiatives such as the Data Act proposal, the Digital Markets Act (DMA), the Digital Services Act (DSA), General Data Protection Regulation (GDPR), the Data Governance Act (DGA) and other proprietary rights.

Compliance with regulations both at the industry and country levels would be required in case of cross-border adoption of an open finance framework.

Cross industry considerations

- Open Finance presents both opportunities and challenges by way of cross-industry standardization. The differing scope of data points and metrics would pose interpretation differences. Technical specification guidelines would have to be created with cross-industry interpretation risks considered.

- Rollout of common API standards adopted across industries to avoid any fragmentation.

Investment considerations

- Financial institutions would need a more convincing case to invest more money and effort in open finance initiatives.

- Any data-sharing initiative among financial partners, whether consumer or non-consumer-related, would have to meet the respective sector needs in a reciprocal manner.

- Infrastructure costs for rolling out and maintaining APIs are considered high.

Security considerations

- Exposing financial data across system landscapes servicing different business lines would require strengthening security standards across industries without compromising security over reachability. Data security and cyber risks continue to challenge the wider adoption of open finance use cases. In a 2023 report, Gartner is forecasting double-digit growth on all enterprise-related cybersecurity spending for the year 2024.

- Consent management should be strengthened and the consumer's willingness to share the data after clear understanding is essential. Customers should be able to determine who gets their data and for what duration and should be able to revoke access at any time.

1.7 HCLTech recommendations

HCLTech's FS consulting team can analyze the API guidelines and framework related to open finance and present its impact on the underlying IT systems and business processes in the context of the customer.

HCLTech, as a MuleSoft partner, can provide expertise in integration technology. HCLTech has developed accelerators such as ADvantage Code for MuleSoft and MuleSoft utility libraries to enable financial services clients to implement their API strategy with a focus.

References

- Report titled 'Payment aspects of financial inclusion in the fintech era', World Bank Group, April 2020.

- openfuture.world | Championing progress in open banking

- Open insurance | Eiopa (europa.eu)

- Security Archives - OpenText Blogs

- 2022 Trends: Small steps or a big leap for Open Finance? - Open Banking Excellence

- Predictions for open banking in 2022 | Tink blog

- finance-2022-open-finance (europa.eu), July 2022.

- What is Open Finance? Definitions, Benefits, and APIs (mx.com)

- BaFin - Open Banking / Open Finance

- Gartner: Spending On Cybersecurity Services Is Outpacing Expectations In 2023 | CRN

- Report titled ‘Open Banking, Open Finance, Open economy’ from Aite Novarica, May 2022.

- Gartner Forecasts Worldwide IT Spending to Grow 8% in 2024