Back in 2003 — some 20+ years ago — one of the key responsibilities when working in the purchase function of an integrated steel plant might have been to track daily stock positions of iron ore pellets, direct reduced iron and naphtha and align with suppliers on planned shipments to meet demand. At least that was the case at one of the biggest plants on the western coast of India, as well as nearly every other plant in the industry at that time. The process was manual, reactive, effort-intensive and, at the same time, critical to ensure supply continuity.

-

Supply continuity through inbuilt supply chain resilience and sustainability: 'Supply continuity' continues to be one of the top focus areas for Chief Procurement Officers (CPOs) even today, and it has become increasingly challenging over time as supply chains have evolved to become significantly more complex. Companies often engage in global sourcing, leading to an ever-expanding supply footprint and globalized operating models. A study published by McKinsey on risk, resilience and rebalancing in global value chains found that disruptions lasting a month or longer now occur an average of once every 3.7 years. The financial toll associated with the most extreme events has also been climbing; on average, companies can expect to lose more than 40% of a year’s profits every decade. This has increased the scope of the procurement function to monitor and mitigate risk beyond typical fulfillment, quality and compliance.

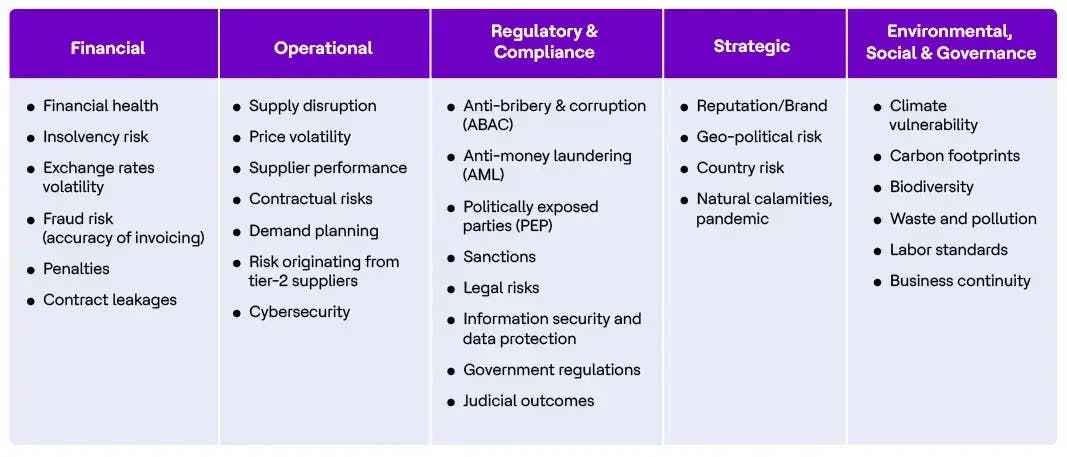

It is evident that procurement must develop comprehensive risk monitoring across financial, operational, regulatory/compliance, strategic and ESG initiatives.

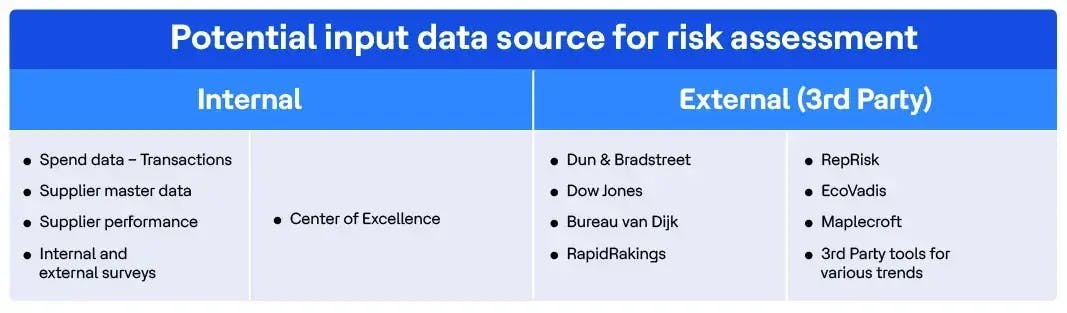

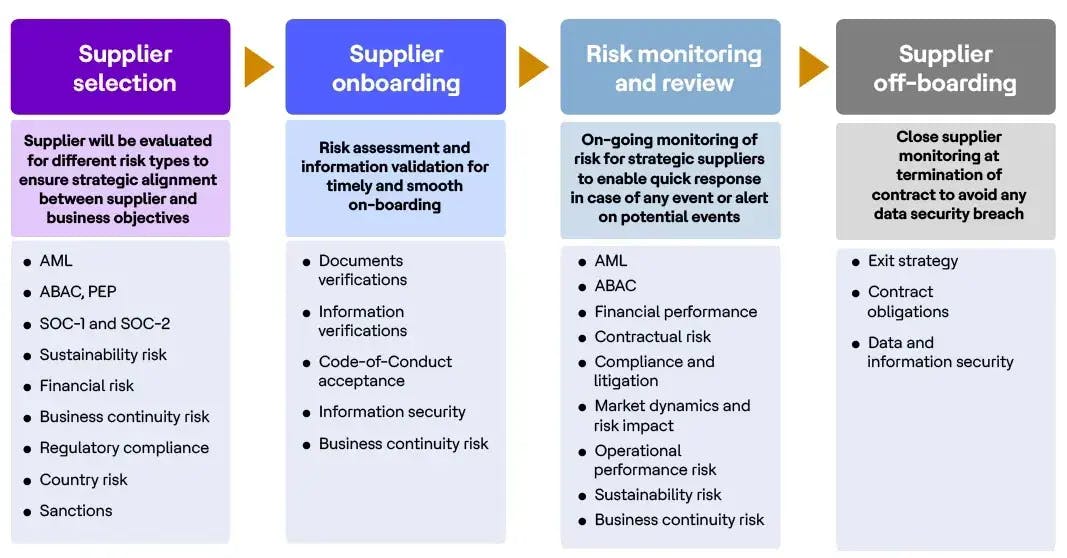

The increased scope also necessitates engagements at different stages of the supplier lifecycle —from supplier selection during sourcing all the way through off-boarding. Careful selection, implementation and adoption of enabling technology will be required to achieve visibility through the supply chain. Combining internal data and external intelligence will generate the required business intelligence and actionable insights.

Let's look at another example: sourcing powertrain components for an automotive company in India almost a decade later (2011). India is a highly competitive car market, and reducing the cost of raw components was a major priority. Buyers across the globe worked with a central team of global category managers within well-defined category strategies and employed levers like global sourcing, used integrated S2P systems/technology and collaborated with various teams, including:

- Engineering to develop should-cost models and potential changes in specification/VAVE

- Supply Chain to optimize packaging/logistics

- Suppliers for innovation and joint process improvements

All the above was done to meet the most important deliverable: savings.

-

Drive business value through cost savings, innovation and collaboration: This savings/spend cost reduction has been a core priority for most procurement organizations, especially when we consider the fact that, depending on the industry, external spending can be as high as 50% of a company’s cost base. From benchmarking analysis, The Hackett Group found that procurement organizations in the top quartile in both business value and operational excellence enjoy a 90% advantage compared to peers on this key metric alone. Looking beyond this to procurement’s return on investment (i.e., spend savings over the total cost of procurement), the performance gap widens, with world-class procurement organizations achieving a 2.4-times advantage over peers. Based on these metrics, most procurement organizations have significant opportunities for improvement.

Due to the high inflation in recent years (with some downward movement in inflation rates in the last quarter), achieving savings has been challenging. Sustained cost reduction in current circumstances will have to be approached with an innovative, collaborative and inclusive mindset over and above the typical levers traditionally used.

One noteworthy shift that has occurred is the broadening of focus from just savings to long-term value creation. To achieve this, it is essential to have the right operating model not just within procurement but with connections and involvement of the business stakeholders and joint ownership of targets, as well.

This means executing value-added processes like category management, strategic sourcing, supplier selection, supplier relationship management and procure to pay. Additionally, procurement should participate in finalizing specifications, be involved in creating policies for demand management, embrace new approaches to the supply market, work with key suppliers to innovate, drive the company’s sustainability agenda and engage with the business to create an impact product/customer.

-

Develop enabler ecosystems -analytics, technology and talent: Another key priority has emerged as the procurement landscape and expectations from the business have evolved: the transformation of the way procurement does business. The terms 'supply continuity' and 'cost savings' now encompass much more than their traditional definitions, and to achieve these necessarily involves leveraging enablers like analytics, technology and talent.

Analytics is one of the foundational elements of transformation. It is integral to business because it allows for creating evidence-based strategy and understanding internal demand through spend analytics, external data through risk analytics and supply market analytics to create business intelligence which can then be used to generate actionable opportunities for long-term value creation.

With access to huge amounts of data, low cost of storage and computing enabled by advancements in technology, it is now possible to:

- Categorize and analyze spending in real-time

- Generate alerts from existing contracts/negotiated agreements

- Predict demand and requisition

- Monitor supplier risks in real-time through third-party data feeds

These advanced analytics drive better decision-making and improve efficiency, ultimately producing results through improved insights and strategies, enhanced process excellence, better assurance of supply, improved risk mitigation, higher operational efficiency and greater collaboration.

Another key enabler is digitization. Most organizations deploy several forms of core procurement technologies. These platforms usually include a combination of spend analytics, eSourcing, contract management and eProcurement (eCatalogs, eInvoicing), among others. The solutions are procurement mainstays for many organizations and will remain relevant for the foreseeable future. While direct procurement has seen the use of these for a long time now, it is indirect categories such as marketing, maintenance, facilities, etc., where spending tends to be unstructured/fragmented and going through a major transformation. Providing a fast and enjoyable experience to the business users making purchases with transparency into supplier options, price and performance through enabling technologies drives higher adoption and compliance. This compliance is key for effectively realizing value generated by upstream category and sourcing functions. A few aspects that are critical to be able to achieve this are a) seamless flow of data across different parts of the sourcing and procurement value chain, and b) intuitive, easy and fast user interface, and it is the job of the procurement technology to make it happen.

A lot of thought needs to go into the unique requirements of an organization while drawing up the architecture of the future technology landscape. It is essential to get the right blend of enterprise resource planning and suite solutions versus the more specialized functionality available from point solutions. Also critical is a thorough exploration of new opportunities to digitize procurement processes to drive additional value like negotiation enabled by artificial intelligence, category management tools and supplier collaboration/innovation solutions.

The last element is talent. For the procurement function to mature, upskilling the team is a must. Each employee needs to be routinely evaluated and upskilled/trained to acquire new skills as they progress to fulfill different sets of roles/responsibilities. It's crucial to ensure that the team is equipped to employ predictive analytics and has the technical know-how to facilitate joint innovation with suppliers, category experience and content, cost modeling and a deep understanding of strategic sourcing and associated commercial levers. These can be fulfilled by developing the capability internally or leveraging external resources.