“What gets measured, gets managed” is a famous quote by Mr. Peter Drucker, a renowned Austrian-American management consultant, educator, and author. The quote is a perfect fit for the sustainability agenda across the world. Adoption and convergence of sustainability reporting standards and disclosure norms progressed significantly in 2021. However, there is still a long road ahead before consistent metrics emerge across all three aspects of Environment, Social, and Governance (ESG).

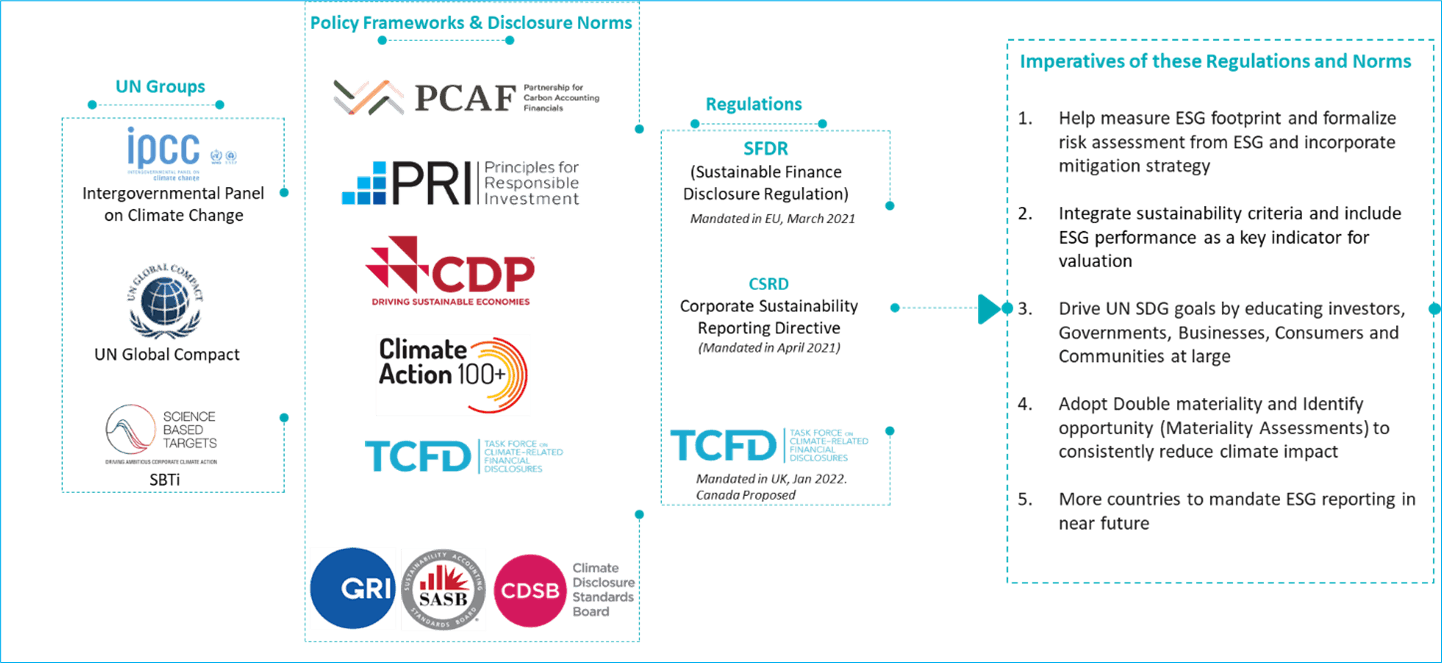

Before we get into the possible future of sustainability reporting, it is essential to understand the existing regulatory frameworks, disclosure norms, and accounting standards. The following diagram provides a sneak peek of such key initiatives and is by no means an exhaustive list –

Figure 1: A sneak peek of the existing regulatory frameworks, disclosure norms, and accounting standards

For a basic understanding of these frameworks, let’s look at the following description –

- IPCC — Intergovernmental Panel on Climate Change — provides policymakers with regular scientific assessments on climate change, its implications, and potential future risks. It has also put forward adaptation and mitigation options. The sixth assessment report was published in Aug 2021.

- UNGC—UN Global Compact—asks businesses to align their strategies and operations with ten universal principles related to human rights, labor, environment, and anti-corruption, and take actions that advance societal goals and the implementing the SDGs.

- SBTi — Science-based Targets Initiative — is a collaboration between CDP, UNGC, World Resources Institute, and the Worldwide Fund for Nature. It defines and promotes best practices in emissions reductions and net-zero targets in line with climate science. It also provides target-setting methods and guidance to companies to set science-based targets in line with the latest climate science.

- PCAF — Partnerships for Carbon Accounting Financials — an industry-led initiative to enable financial institutions to consistently measure and disclose the GHG emissions financed by their loans and investments. Currently, signed by 183 institutions globally with $ 56 TN in assets, PCAF is more focused on measuring “Financed Emissions”.

- TCFD — Taskforce on Climate-related Financial Disclosure — led by Michael Bloomberg, TCFD was set up by the Financial Stability Board (FSB) todevelopconsistent climate-related financial risk disclosures for companies, and provide information to investors, lenders, and underwriters.

- UN PRI — Principles for Responsible Investments — is the world's leading proponent of responsible investment. It works to understand the investment implications of Environmental, Social, and Governance (ESG) factors. It is supported by an international network of asset managers and investors with $110 trillion assets, 7000 signatures across 135 countries.

- CDP —Carbon Disclosure Project — helps companies and cities disclose theirenvironmental impact. It aims to makeenvironmental reportingandrisk managementa business norm, driving disclosure, insight, and action towards asustainable economy. 8,400+ companies in the US, UK, India, China, Germany, and more have aligned to the CDP.

- Climate Action (CA) 100+ — an investor initiative (with $ 32 trillion in assets) to ensure 161 of the world's largest corporate greenhouse gas emitters take necessary action on climate change. This involves investors calling on companies to improve governance on climate change, curb emissions, and strengthen climate-related financial disclosures.

- SFDR — Sustainable Finance Disclosure Regulation — mandated in March 2021 in Europe, the SFDR isdesigned to help institutional asset owners and retail investors understand, compare, and monitor the sustainability characteristics of investment funds by standardizing sustainability disclosure. This is targeted at financial market participants and advisors.

- CSRD —Corporate Sustainability Reporting Directive — a proposal of the CSRD was made in April 2021 by the European Commission to extend the existing requirements of the NFRD. It has extended the scope of NFRD requirements to all listed as well as large companies. The proposal, however, has exempted the listed micro-enterprises.

- CDSB — Climate Disclosure Standard Board — aims to provide material information for investors and financial markets. It integrates climate change-related information with mainstream financial reporting, such as the annual report or the Form 10-K. Currently, 374 companies across 32 countries are using the CDSB frameworks.

- GRI —Global Reporting Initiative — is an international independent standards organization that helps businesses and governments understand and report their impacts on issues, such as climate change, human rights, and corruption. GRI’s sustainability reporting services help you get accurate sustainability reporting integrated with financial reporting. It is more prominent in the EU. GRI exists to help organizations be transparent and take responsibility for their impacts so that we can create a sustainable future.

- SASB —Sustainability Accounting Standards Board— is an independent nonprofit organization that sets standards to guide the disclosure of sustainability information of financial information by companies to their investors. It has 77 industry-specific standards for major industries. It is more prominent in North America and is used by companies across 50+ countries and 75+ industries.

A glimpse of the future evolution of regulatory norms across countries

Europe is currently leading the sustainability-driven transformation and has already brought in two mandates around it. SFDR— Sustainable Finance Disclosure Regulation Phase-1 was already mandated in March 2021, and Phase -2 will be mandated by January 2023 with a more strictly defined EU-specific taxonomy to avoid any greenwashing. SFDR is primarily applicable for financial entities. EU has also launched the Corporate Sustainability Reporting Directive (CSRD), an extension of NFRD and has been mandatory for all EU-based micro-enterprises since 2021.

UK has also mandated TCFD disclosure norms to be followed from January 2022 for all large companies operating in the UK. In India, the Business Responsibility and Sustainability Report (BRSR) will be mandatory for the top 1000 NSE-listed companies by SEBI from April 2023. In the US, the Securities and Exchange Commission (SEC) is working to define a regulatory framework and taxonomy for sustainability investments, especially for integrating climate risk. In Canada, the Canadian Securities Administrators (CSA) have published climate-related disclosure requirements which are aligned with TCFD norms. Australia has also asked businesses to start reporting on ESG aspects starting December 2022 voluntarily, and regulation regarding the same will be implemented soon. India has launched the details for the BRSR framework, and SEBI has asked the top 1000 listed companies to report on ESG aspects mandatorily.

Convergence of financial reporting and sustainability reporting

The International Sustainability Standards Board (ISSB) was launched by IFRS (International Financial Reporting Standard) foundation during COP26 at Glasgow in 2021. ISSB is tasked with integrating CDSB, SASB, Integrated Reporting (IR) Framework, and TCFD norms with IFRS financial standards. On the other hand, EFRAG (European Financial Reporting Advisory Group) is developing Europe-specific standards with CSRD and SFDR regulations and is also integrating PCAF, which has created “The Global GHG Accounting and Reporting Standard” for the financial industry. It will be interesting to see if sustainability reporting ends up being very similar to financial accounting with two prominent global standards— GAAP and IFRS.

To summarize, while significant progress happened in 2021 on sustainability disclosure norms and frameworks, the time has already arrived to introduce regulations across the world and ensure progress towards SDG goals.