Enrollment is a significant step in the member’s journey in a health insurance payer ecosystem. As the first touchpoint in the ecosystem, enrollment is critical for establishing a long-lasting relationship with customers.

Payers with a flexible, scalable platform gain the mindshare of onboarded customers and are ready for a future of increasing enrollment and enhanced profitability. With the proliferation of health insurance subsidies on exchange platforms, a strong migration toward Medicare Advantage plans and increased enrollment in Medicaid, payer sites are experiencing higher activity volumes during open enrollment periods (OEP).

Here are a few statistics that show tremendous enrollment spikes:

- In 2021, more than 26 million members enrolled in Medicare Advantage plans, accounting for 42% of the total Medicare population, as per a report by Kaiser Family Foundation

- The Centers for Medicare & Medicaid Services (CMS) reported that as of January 2022, Marketplace enrollment reached 14.5 million in January 2022, including 4.6 million new plan selections

To accommodate members in all the above segments, payers need a well-established, future-proof member enrollment platform that verifies, onboards, engages and serves members right from the start—before members leave one payer to join a competitor.

Member enrollment delays and errors impact a payer’s ability to satisfy members' high service expectations. Members expect same-day benefit availability once enrolled. Delays in onboarding lead to gaps in ensuring timely benefits and care delivery.

In short, to deliver enhanced customer experience and satisfaction, payers need real-time enrollment.

Are payers ready to scale up?

While most payers have in-house enrollment platforms, some reduce administrative burdens and other operational issues by enrolling members through HITs (health information technology). Most enrollment platforms have huge gaps in seamlessly adapting to members’ increasing enrollment demands. Most payer CIOs see enrollment platform modernization as a top digital transformation initiative.

Other pressing challenges that compel payers to revisit their platform strategy are:

People issues

- Enrollment is a people-intensive process with a high cost per member, leading to overutilization of staff for data intake, file conversions, data reconciliation and processing

- More focus on healthcare services than member satisfaction. Better member engagement and experience are no longer value-added options—they are must-haves

Technology issues

- Enrollment is plagued by inefficiency and disconnected data, creating concerns for members and amplifying the possibility of penalties for payers

- Payers are challenged by outdated, inflexible technologies that rely on custom IT development, including hard-coded changes in the enrollment lifecycle

- Member intake channels lack an omnichannel experience and single-window enrollment for members and employers

- Paper forms result in data errors and slow processing

- State- and jurisdiction-specific regulatory language in enrollment forms and policy documents can be a burden for the payer’s legal department

- Managing complex in-house enrollment solutions can result in high maintenance costs

Process issues

- Multi-source intake, bulk enrollment and special underwriting vary, depending on the carrier’s unique business requirements and business rules

- Tedious intake processes include several manual interventions, which slow down processes

- Process transparency and data inaccuracy persist in most enrollment processes

- Traditional ways of implementing enrollment solutions in payers’ on-premises in-house systems are complex and intensive solutions that are unable to be flexible and scalable for rising demands

- Converting the inflow of enrollment files, data and feeds into a standardized format (e.g., EDI 834) is still not fully streamlined due to quality issues and non-standardized parameters, even with standardized intake templates

- Most process issues lead to a poor enrollment experience for members, primarily due to a longer turnaround time

These aforementioned challenges, encompassing people, technology and process issues, contribute to prolonged turnaround times, subpar member experiences, convoluted systems, excessive administrative workload, mounting regulatory pressures, escalating demand and significant data quality concerns. Together, these challenges suggest that payer’s need a next-gen enrollment platform that is scalable, flexible and adaptable to fix today’s issues and be ready for the future.

What should a future-ready member enrollment platform look like?

While strategizing their future-ready enrollment platform, payer CIOs need to prepare for building a platform that:

- Gives members an intuitive, real-time and omnichannel experience

- Includes features such as single sign-on, the latest and most excellent provider directory, verification modules and seamless routing of files from all sources

- Automates and boxes timely resolution of data issues and enrollment fallouts

- Provides a well-equipped, highly responsive customer service functionality that gives members round-the-clock support

- Enables real-time, 360-degree view reporting that tracks compliance mandates and enrollment-related progress

- Is agile enough to handle massive spikes in volume, especially during the OEP

- Accommodates and adapts to ever-changing regulations

- Seamlessly integrates enrollment feeds with downstream core administration applications for billing, claims processing and other member services

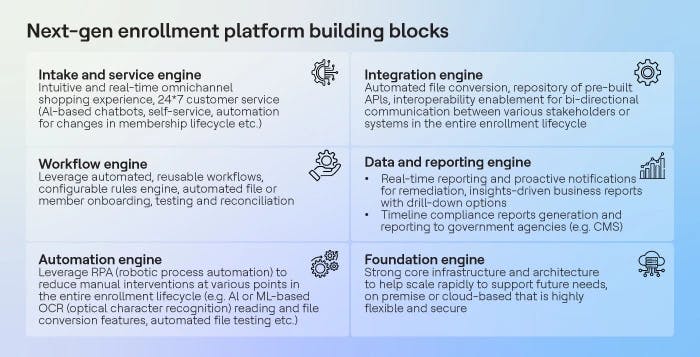

The building blocks of the reimagined member enrollment platform must include the following:

- Intake and service engine for seamless omnichannel intake and member experience

- Workflow engine for automated enrollment process flow

- Automation engine to reduce manual touchpoints wherever possible

- Integration engine for real-time integration and interoperability

- Data and reporting engine for timely mandated reporting and internal decision-making support

- Foundation engine to enable a highly flexible, scalable, secure base that can handle current needs and future spikes

Is your company ready for the future?

A future-ready member enrollment platform will address most of the challenges payers face today. A next-gen enrollment platform will help payer executives fast-track their digital transformation initiatives, improve the customer experience, drive customer loyalty and retention—and boost profitability.

References:

Centers for Medicare & Medicaid Services. (2021, December 21). HHS Announces Increased Marketplace Enrollment Trends with Nearly 4.6 Million New Plan Selections Since Open Enrollment’s Start. Retrieved May 3, 2022 from

Meredith Freed, Jeannie Fuglesten Biniek, Tricia Neuman. (2021, June 21). Medicare Advantage in 2021: Enrollment Update and Key Trends. Retrieved May 2, 2022 from