Maximizing shareholder value via sustainable growth and robust margins is a top priority for CXOs. In this blog, we explore the significance of a structured working capital optimization framework and its implementation in large, complex organizations with diverse functional priorities.

During the pandemic, organizations recognized the need for sufficient cash reserves as customer payments slowed and suppliers demanded timely payments. Post-pandemic, increased cost of funds affected the viability of business models, and organizations also faced challenges in maintaining credit ratings, adding further pressure. This prompted a shift toward unlocking working capital, rather than relying on costly borrowed capital for reinvestment in business growth.

Every organization recognizes the significance of optimizing working capital. Yet, many struggle to streamline the programs scattered across different enterprise functions and maneuver conflicting priorities.

How to build a structured working capital optimization framework?

For any strategic program, endorsement from the organization's top executive is essential — whether it be the CEO, CFO or Financial Controller. Secondly, successful implementation demands close collaboration and commitment from key stakeholders responsible for the tied-up working capital, those significantly affected by substantial working capital investments. The core committee, chaired by the sponsor, should include heads of the following value streams:

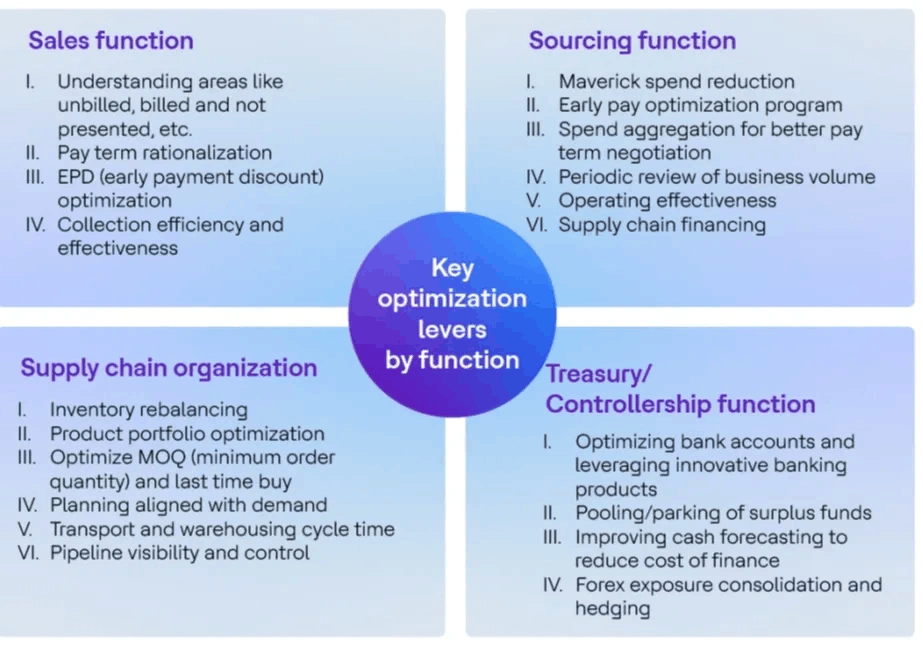

- Sales function

- Sourcing function

- Supply chain organization

- Treasury/controllership function

The program charter should effectively outline the development of the following essential elements of the framework:

Working capital command console for integrated metrics: Achieving this task poses challenges in a large and intricate organization. The underlying data is scattered across diverse platforms, applications and workstreams, encompassing sales, sourcing, supply chain and treasury. To address this, establishing a data lake and integrating multiple databases is crucial for real-time visibility into key metrics of different value streams. This necessitates thoroughly comprehending each value stream and its essential metrics to effectively track and monitor the impacts on working capital. Examples of sales and customer side metrics include unbilled deliveries, presentment drops, past-due metrics, Daily Sales Outstanding (DSO) trends, customer payment terms demographics, contractual commitments, billing cycles, bad debts and other similar indicators.

Business intelligence: Consolidating metrics addresses one aspect of the challenge, but a comprehensive solution involves in-depth analysis of multiple datasets to translate them into actionable insights. A profound understanding of business strategy, priorities, policy framework and the KPIs structure is imperative. For instance, a thorough examination of detailed customer payment terms and early payment rebate analysis is essential, correlating strongly with market dynamics, product understanding, sales policies, customer segmentation and the cost of funds. This approach enables a broader perspective to identify inefficiencies and areas for improvement.

Consolidating varied programs/activities across value streams: It is crucial to recognize that working capital programs exist in some capacity within each value stream, often operating independently. Understanding these programs, as well as their effectiveness and objectives, is key. Once this understanding is established, identifying synergies, setting common goals, offering guidance for course corrections and defining new programs with clear ownership in each value stream becomes essential. This process also consolidates smaller initiatives across various BUs/regions under a unified framework. Each program should follow a structured approach with a defined charter, objectives, achievement milestones and clear governance framework.

Monitoring and governance: Ensuring the effective monitoring of interdependent and cross-functional metrics is essential to understanding the cause and impact of working capital optimization programs on them. Moreover, structured governance is necessary to oversee agreed-upon programs, key milestones, clearly defined program KPIs, required support, conflict resolution, budget approvals and the promotion of synergies. The governance framework should be designed at three levels:

- Steering governance: The objective is to seek guidance and make strategic decisions related to business policies and key investments needed for programs across value streams.

- Tactical governance: This involves collaboration among heads of value streams such as sales, supply chain, sourcing and treasury. They offer mentorship to address cross-functional challenges and assess the repercussions of significant changes proposed by operational teams.

- Operational governance: This structure can be implemented for each value stream with essential cross-functional representations. The objective is to identify key milestone risks and facilitate agreed-upon actions.

Accountability and defining KPIs: This is a crucial element of this framework. Working capital optimization must not be treated as a secondary initiative. Certain metric targets should cascade down to the KPIs of team leaders, cluster heads and even heads of value streams. This approach fosters a self-motivated environment across various functions and establishes clear accountability for each program. Furthermore, having a clear RACI (responsible, accountable, consulted and informed) framework across essential functions is beneficial.

As a best practice, here are examples of key optimization levers that enhance the organization's working capital.

It's time to rethink, recreate and revive your working capital strategy to maximize shareholder returns and propel business growth.