Anti-Money Laundering (AML) is a set of policies and guidelines that helps banks and financial institutions (FIs) combat money laundering, a financial crime associated with disguising the proceeds of crime as legitimate income. According to UNODC reports, money laundering costs between $800 billion-$3 trillion annually to the global economy which is roughly 2-5% of its entire value.

To mitigate these losses, governments and regulatory bodies around the world have set AML regulations that require FIs to adhere to customer identification program requirements around collecting information from their customers to efficiently monitor customer engagements and activities. Customer Identification and Verification (ID&V) is the cornerstone of AML and done efficiently, ID&V helps banks setting a robust foundation for secure business operations, especially as a part of the perpetual KYC (pKYC) process, which includes customer KYV and bank KYC.

that includes digital identity solutions, customer identification program requirements, a robust verification process and all customer due diligence. This collaboration will not only ensure compliance with respect to identifying information, CIP verification and financial crime information,

ID&V: An opportunity and a challenge

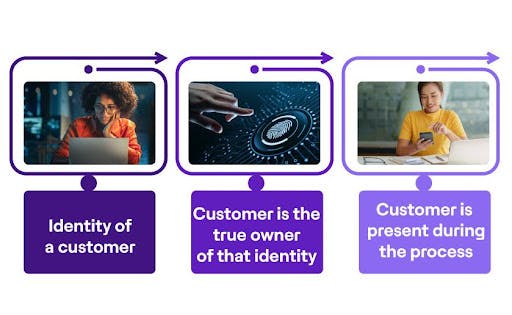

Customer identification and verification (ID&V) is a critical, and unfortunately often painful, part of the customer onboarding and AML/CTF processes that requires an organization to confirm several pieces of information as part of its customer identification programs (CIP):

- The identity of a customer

- That the customer is the true owner of that identity and

- That the customer is present during the process.

For banks and FIs, ID&V has been a crucial aspect of the account opening process, serving as the first point of interaction between the institution and the customer. The purpose of ID&V is to verify the customer's identity and ensure compliance with legal requirements and security protocols while preventing financial crimes such as identity theft and fraud. The extensive adoption of ID&V has fueled the growth of the global e-KYC market, which was estimated to be valued at $447.53 million in 2021 and is expected to experience a compound annual growth rate (CAGR) of 22% until 2029.

As critical as the ID&V process is, it is not all smooth sailing for banks and FIs. The unfortunate reality is that for most established financial institutions, ID&V remains an overly complex process that is heavily reliant on manual work. And as with all manually reliant processes, this results in poor customer experience, high operational costs and an increased risk of compliance gaps. Moreover, these compliance gaps during onboarding quickly accumulate into vast backlogs of remediation work that further reduces efficiencies and increases costs.

ID&V delivery in financial services

Finding a Robust Solution

The good news is that there is an abundance of mature and efficient solutions on the market to manage ID&V and combined with the right operating model they simultaneously boost customer experience, compliance, and cost-efficiency. Reports indicate that the market for digital identity solutions was already valued at $27.9 billion in 2022, and expected to reach $70.7 billion by 2027 at CAGR of 20.4%.

Mastering the combination of technology and operating model gives a strong competitive advantage through ease of onboarding. While this is often an integral part of the strategy for the new, digitally savvy players in the market, the more established FIs often struggle and end up losing customers.

So, what can legacy and established banks and FIs do? The answer will lie in a thorough assessment of their ID&V delivery capabilities. Based on decades of experience and available market research here are the key questions that can reveal the level of untapped potential in an organization’s ID&V delivery model:

- Do you have a LEAN verification process for identifying information?

In many cases, processes do not follow a cohesive design and are simply “cobbled together” from various activities and stakeholders over time. However, by rethinking the process with compliance as a key component, rather than an afterthought, companies can unlock significant untapped potential. - Is your data standardized and accessible?

The strength of a process lies in the quality of its data foundation. By defining all elements of the process in terms of standardized data that is easily accessible in real-time, organizations can achieve an elevated level of Straight Through Processing (STP) and automation. - Do you have the skills for efficient exception handling?

Not all parts of a process can be automated. There will always be a need for some level of exception handling, such as a risk-based approach to ID&V for high-risk entities. However, achieving this efficiently requires the right combination of a skilled workforce and a clear set of principles and procedures, such as a well-defined risk model and policy. - Do you leverage state-of-the-art FinTech?

There is a vast array of solutions available that can automate processes, either partially or completely, depending on strategy, services, and clients. These solutions are broadly divided into platforms that cover all aspects of onboarding and AML, including- ID&V

- Best-of-breed "plug-ins" that focus solely on ID&V as a single element of the onboarding and AML process, and Supporting tools, such as automation tools, workflow tools, customer KYC, customer due diligence and OCR, which together can power your process.

- CIP verification collaborations for assured security

ID&V delivery in financial services is a crucial component in bank KYC that helps ensure the security and reliability of financial transactions. With the increasing number of financial frauds and identity theft, the adoption of advanced ID&V technologies has become essential for financial institutions in verifying the identity of customers and providing a secure and convenient means of accessing financial services.

Organizations struggling to effectively utilize technology implementations for their ID&V delivery processes and customer identification programs (CIP) need not go through it alone. By partnering with established financial technology specialists such as HCLTech, organizations can leverage decades of technology expertise and industry experience to develop a customized and secure ID&V delivery model that includes digital identity solutions, customer identification program requirements, a robust verification process and all customer due diligence. This collaboration will not only ensure compliance with respect to identifying information, CIP verification and financial crime information, but also deliver enhanced overall customer experience for more sustainable growth.