I turned 60 years old a couple of months ago, and seem to be spending more time reflecting on the past, while envisioning the future. Maybe it is because of my age milestone, but I also think it is directly in response to the inflection point we are seeing for oil and gas production and exploration companies. The upstream oil and gas players are now publicly talking about how they are going to help society that is responding to global warming and decarbonization. Yes, the same companies that for the last century have been working every day to bring carbon-based fuels to society, are now trying to plan how they transition out of that business.

This doesn’t mean that in the next 5, 10, 20 years or beyond, maybe not even in my lifetime, that we’ll see fossil fuels completely fade into the sunset to join other stalwarts like 8-track, cassette and video tape formats. But, it does mean we have to be more thoughtful in how we produce these fuels and account for them. The traditional accounting of volumes and dollars will still be important but now there is a third dimension. No, not the alternate dimension of the Twilight Zone, but rather the dimension of the carbon footprint that these companies leave in the sand as they march to their quarterly earnings calls. These earnings calls used to be centered around the price of oil and gas on the market. While that is still true, more and more executives are having to explain their net carbon initiatives, and how they will be in compliance with the various pacts made around the world.

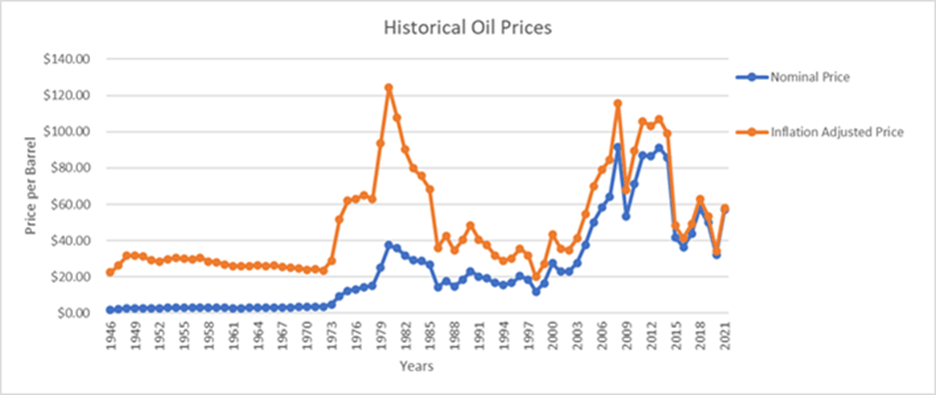

Over my 40 plus years in the oil and gas industry, we’ve seen the economic impact that prices have taken on our business and the way we get regulated. Although we focus on the dramatic price shifts we’ve seen due to external and supply/demand forces, if we go back almost 40 years, price stability used to be the norm. In the chart below, that stability has seen various “interruptions” and “resets” to new normal levels and the oil and gas industry has adjusted.

The spikes we saw in real prices, and the corresponding inflation adjusted prices, have accounted for much more volatility and uncertainty. Looking back to 1946, prices really didn’t change for almost 30 years. From 1973 to 1988, price volatility was the start of the new normal. However, I’m not sure that anyone expected to have the dramatic volatility which we’ve seen for the last 20 years.What do we think the graph profile will look like going into 2022 and beyond? How does the shift from fossil fuels over the next 50 years impact this curve? Much of the volatility from the past is directly related to supply and demand. We know that there are still vast oil and gas reserves left in the ground, so we don’t have a supply problem. We are saying that we expect demand to shift away from these deposits to fuels that have less impact on the environment. Frankly, impact will be more on the related economies such as transportation, utilities, petrochemicals, and everyday household items like plastics which are dependent on oil and gas.

For the next 50 years, which hopefully I see most of them, I’m really interested in how the oil and gas industry will adjust. How will our “Blockbuster” moment be managed? We’ve done a great job of rising to challenges in providing the energy necessary for the world to survive and thrive.

In 1976, Tommy Shaw, the current front man for the group Styx, wrote a song called “Crystal Ball”. In the lyrics, he wrote…

“I wonder what tomorrow has in mind for me

Or am I even in it’s mind at all

Perhaps I’ll get a chance to look ahead and see

Soon as I find myself a crystal ball”

I can’t help but wonder if those lines are applicable to our oil and gas industry and how we can proactively write the story on how we changed so that tomorrow does have us in mind.