In the face of ever-evolving social and climatic conditions and escalating disruptions, the necessity for a robust and concrete business framework has never been more critical. Numerous governmental bodies have now shifted their focus towards environmental risks. This shift is evident in actions such as the Biden administration's alignment with the Paris climate agreement and the EU's decision to make ESG a regulatory mandate. Every major economy is now concerned about the impact of environmental risks on business.

ESG, better known as Environmental, Sustainability and Governance, represents a set of policies, processes and standards aimed at enhancing an organization's operational efficiency. This is achieved by evaluating the impact of an organization's activities on various stakeholders, including employees, the environment and the climate.

The 'Environmental' component of ESG evaluates an organization's environmental impact, considering factors such as carbon emissions, water usage and pollution levels. The 'Social' component focuses on the organization's impact on stakeholders like investors, resources and employees. The 'Governance' component, on the other hand, concentrates on the organization's governance structure, board reviews and corporate policies. Furthermore, investors and analysts monitor the sustainability and ethical impact of an organization using the ESG framework. The results of these ESG criteria assist analysts and investors in identifying organizations whose vision, values and goals align with their objectives. Organizations scoring higher on ESG parameters are considered more sustainable, which directly impacts their financial performance and ability to engage with business leaders and investors.

G20 members contribute nearly 80% of the world's greenhouse gas emissions. However, global business leaders are now focusing on sustainable growth. The G20 forum has committed to reducing gross emissions by 80%, a commitment supported by their respective governments. The introduction of ESG regulations and standards like SFDR, NFRD, EU Taxonomy, The Company Act, 2013-Section 135(m) and SASB have compelled organizations to follow the path of sustainable growth. Organizations are now implementing measures to reduce GHG emissions, focus on climate and include diversity. HCLTech, for example, aims to achieve net zero by 2040 with a 50% reduction of absolute scope 1 and scope 2 emissions by 2030, compared to the 2020 baseline.

While there is a growing interest in ESG issues, business leaders must also adopt a comprehensive approach to implementing their ESG commitments through their TPRM programs. This approach will help businesses realize the potential to pave the way for a sustainable future. But the question remains, how do we achieve this?

The answer lies in creating a framework for ESG risk management. This framework should cover traditional risk competencies such as contractual risks, operational risks, compliance risks and regulatory risks, as well as all aspects of ESG risks, such as climate risk, legal risk, structural risk, compliance risk and data protection risks.

From a TPRM perspective, the framework should focus on current risk profiles, how third parties are used and managed, which regulations apply and the organization's ESG guidelines. To cover ESG risks, organizations should start by identifying ESG risks within their vendors, understanding the scope of services they provide and the threat they pose to the organization. This can be achieved by conducting a risk assessment on the vendor.

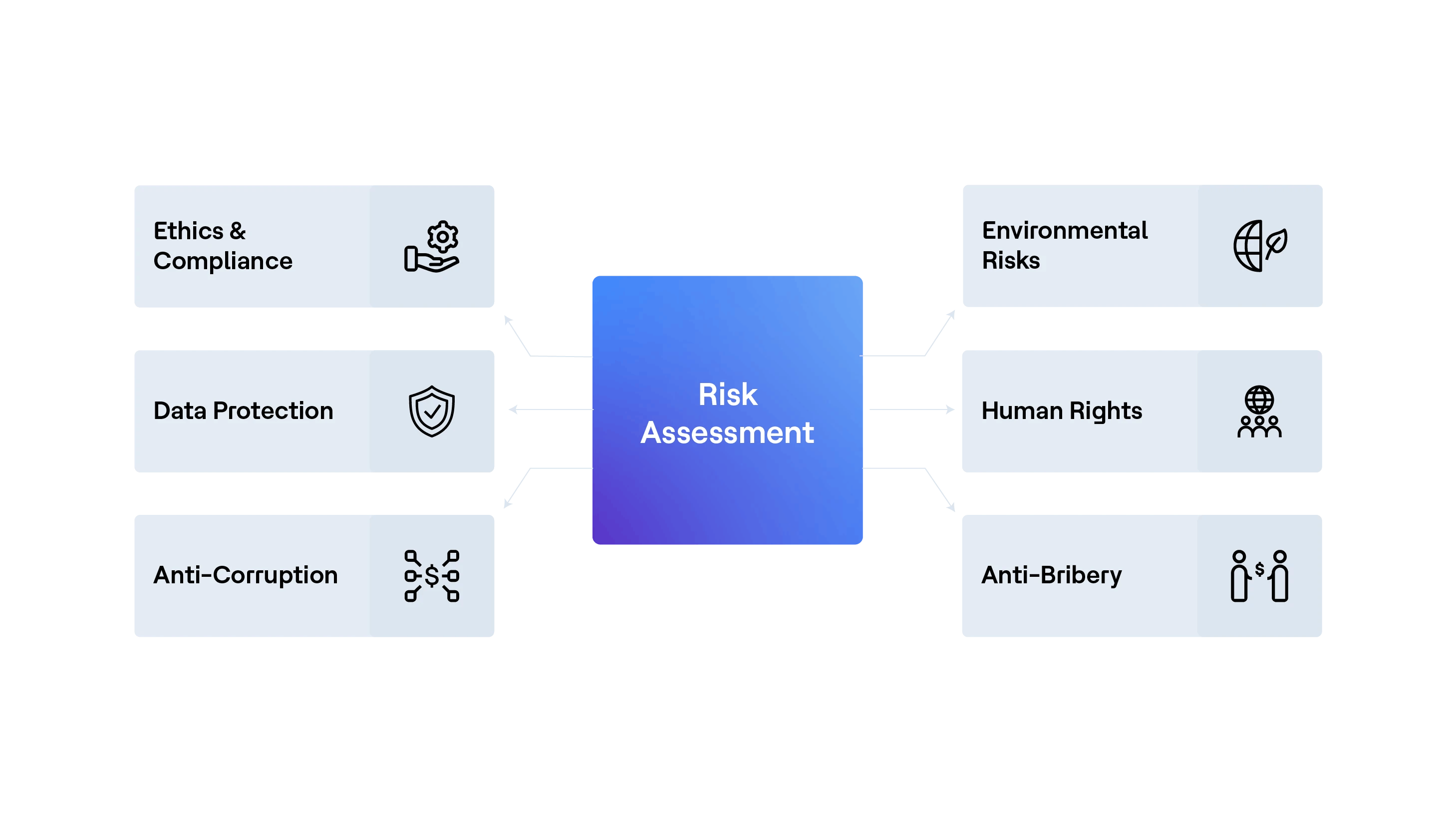

The risk assessment should focus on areas such as:

- Ethics & Compliance: It is critical to identify third parties whose business ethics align with the organization's ethics.

- Environmental Risks: Organizations should be aware of the environmental risks posed by their vendors.

- Human Rights:Necessary steps should be taken to ensure that the vendor complies with all human rights laws and is not involved in unethical practices like gender bias, modern slavery, etc.

- Anti-Bribery & Anti-Corruption: Organizations must ensure that all their suppliers are not part of any negative activities such as bribery and corruption. This can be achieved by conducting thorough Background Checks and Anti-Bribery and Anti-Corruption screenings.

- Data Protection: Organizations should focus on protecting sensitive and confidential data. Hence, vendors should be evaluated on the safeguards they have in place to prevent data loss.

Continuous monitoring and reporting are also key aspects of the ESG risk framework. Organizations should ensure that all the issues identified in the assessment are monitored and mitigated. Furthermore, the organization should focus on developing and implementing documented policies and procedures for all ESG-related norms. This will help in boosting third-party management and will assist in maintaining necessary documents for audit and reporting purposes. Furthermore, promoting ESG initiatives will help the organization foster an ESG culture.

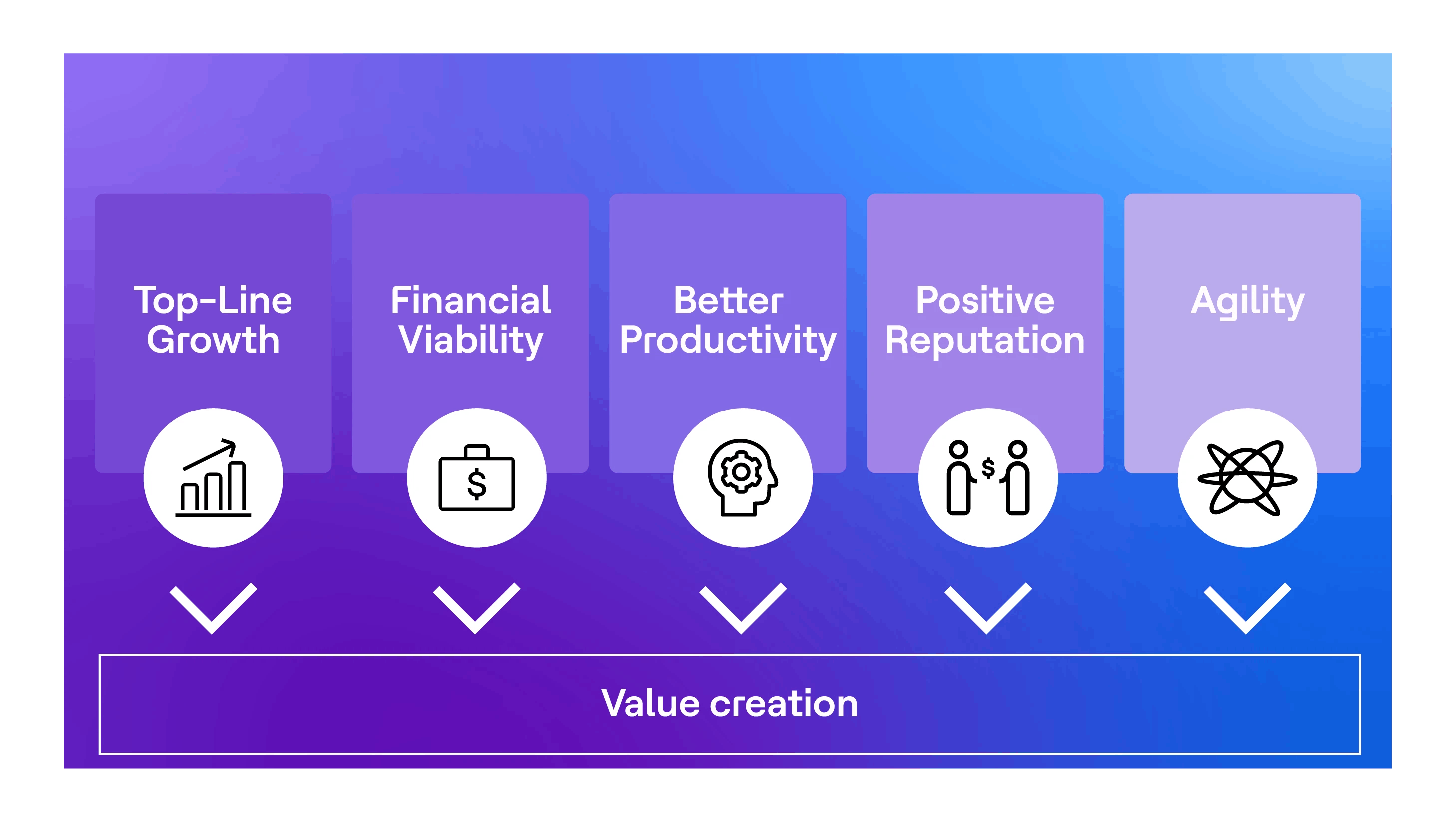

By integrating ESG with TPRM, organizations are not only complying with standards and regulations but are also creating value for themselves. Here are some benefits:

- Top-Line Growth: Sustainability is a key factor in buying decisions. Thus, having a strong foothold in ESG will help the organization in attracting new customers, entering new markets and retaining existing customers.

- Financial Viability: A company is more likely to be a trusted partner if it has a commitment towards the environment and human rights. Good sustainability practices often have a positive impact on business.

- Better Productivity: Workers are more devoted to their employers when they get fair treatment. A compelling ESG proposal may support businesses in attracting and retaining top talent, improving employee engagement by fostering a sense of mission and boosting overall productivity.

- Positive Reputation: A vendor who adheres to ESG principles is less likely to bring about scenarios like environmental repercussions that might harm your organization's reputation.

- Agility: Third parties or vendors who abide by ESG norms are less susceptible to disruption from elements like socio-regulatory changes or environmental repercussions.

"There's a lot to consider at the intersection of business and social work. It's about earning a lot of money while adding a lot of value to people’s lives and making the world a better place."

- Hendrith Vanlon Smith Jr, CEO of Mayflower-Plymouth

With a strong and realistic ESG framework that can be coupled with third-party risk assessment and monitoring procedures, it will be easier to comply with ESG standards, promote sustainability programs and improve business outcomes.