Introduction

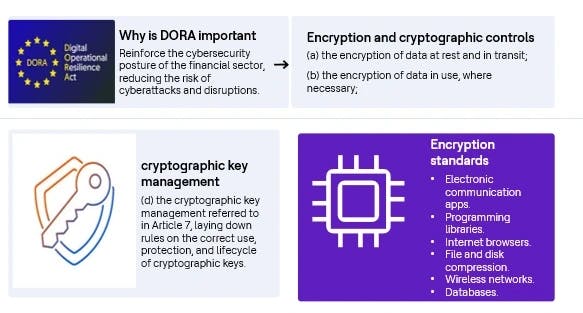

The European Union's Digital Operational Resilience Act (DORA) marks a compelling evolution in the digital security landscape for financial institutions. As the sector increasingly relies on intricate digital infrastructure, the imperatives of safeguarding against ICT-related disruptions and ensuring robust operational resilience have never been more significant. DORA aims to fortify these aspects by mandating rigorous standards and practices, prominently featuring the regulation of cryptography and comprehensive resilience measures.

Cryptography regulation under DORA

Cryptography is the cornerstone of digital security, particularly in the financial sector, where the protection of sensitive information is paramount. Under DORA, cryptography regulation is elevated to new heights, ensuring a consistent and universally accepted standard across the European financial landscape.

- Encryption standards: DORA sets forth the adoption of advanced encryption standards to maintain high data security. This includes implementing state-of-the-art algorithms that offer robust encryption methodologies. Financial institutions must utilize encryption techniques that adhere to stringent benchmarks, thereby minimizing the risk of unauthorized data access and cyber threats. The legislative framework necessitates a comprehensive approach to key management, ensuring that keys are generated, distributed and stored securely. Financial entities must adopt practices that mitigate the risks of key exposure and loss, incorporating multi-factor authentication and secure key storage solutions.

- Compliance and auditing: Compliance with DORA's encryption standards is not a one-off task but an ongoing obligation. Financial institutions must regularly audit cryptographic systems to verify adherence to prescribed standards. Periodic assessments are crucial to identify emerging vulnerabilities and to ensure that encryption protocols remain robust against evolving threats. In addition to internal audits, institutions are expected to engage in third-party evaluations to provide an external validation of their compliance status. These audits facilitate a dynamic approach to security, fostering a culture of continuous improvement and adaptation in response to new challenges.

- Operational resilience measures: In conjunction with cryptographic regulations, DORA outlines extensive measures to strengthen financial institutions' operational resilience. This comprehensive framework encompasses various facets of preparedness, response and recovery to ensure institutions can withstand and bounce back from ICT-related disruptions.

- ICT Risk Management: Central to DORA's operational resilience directive is the adoption of a thorough ICT risk management framework. Financial entities must take proactive steps to identify, assess and mitigate risks that could compromise their digital infrastructure. This involves conducting regular risk assessments, vulnerability scans and penetration testing. These measures enable institutions to uncover and address potential weaknesses before they can be exploited. By maintaining an updated risk profile and staying vigilant against new threats, financial entities can enhance their defensive posture and reduce the likelihood of significant disruptions.

- Incident response and recovery: DORA mandates the development of comprehensive incident response plans for timely and effective action when cyber incidents occur. Institutions must formalize procedures for detecting, reporting and recovering from such events, ensuring that every incident is managed systematically. An incident response plan under DORA would typically include steps for immediate containment, investigation to understand the extent of the breach, remediation to fix vulnerabilities and measures to prevent recurrence. The goal is to minimize operational impact and protect customer data.

- Third-party risk management: Financial institutions frequently rely on third-party service providers for various ICT functions, which introduces additional layers of risk. DORA underscores the necessity of rigorous third-party risk management practices to ensure these providers meet the same resilience standards. Institutions must diligently assess their service provider's security measures and operational resilience. Regular performance reviews and security evaluations are integral to maintaining a secure supply chain and ensuring continuous alignment with DORA's requirements.

Benefits

The adoption of DORA promises several substantial benefits for the financial sector, underscoring its importance and relevance in today's digital-first environment. Some of these benefits are listed below:

- Enhanced security and trust: By enforcing stringent cryptography regulations and operational resilience measures, DORA enhances the overall security landscape of the financial sector. Institutions can offer greater assurance to their customers about the safety and privacy of their financial data, building trust and confidence.

- Reduced risk of disruptions: With robust ICT risk management and incident response strategies, institutions are better equipped to handle and recover from cyber incidents. This reduces the risk of prolonged disruptions with significant financial and reputational repercussions.

- Standardized resilience practices: DORA promotes consistent resilience practices across the European financial sector. This standardization helps ensure that all entities adhere to best practices regardless of size, creating a cohesive and resilient digital ecosystem.

- Competitive advantage: Financial institutions that proactively comply with DORA mitigate risks and gain a competitive edge. Demonstrating compliance can be a unique selling point, attracting customers who prioritize security and operational stability in their financial service providers.

Conclusion

The European Union's Digital Operational Resilience Act (DORA) represents a monumental step in safeguarding the financial sector against digital threats. By enforcing robust cryptography regulation practices and comprehensive operational resilience measures, DORA aims to protect the sector's digital infrastructure and ensure its stability and security in an increasingly digital world. Financial institutions must embrace these regulations not merely as a compliance obligation but as an opportunity to strengthen their operational framework and enhance their resilience. In doing so, they can safeguard their assets, protect their customers and navigate the complexities of the digital age with confidence and assurance.