Blockchain-based tokenization has tremendous potential to help businesses reach new customers due to the trust, fractionalization, and financial inclusion promoted by blockchain.

Blockchain can provide a decentralized mechanism to allow asset owners (or publishers) and buyers to transact, own, and use tokens for the asset (such as digital art, carbon offset credit, or music subscription token) in an immutable and transparent manner.

The evolution of digital payments, fraud prevention, and digital ownership are also driving industries to move from centralized to decentralized systems. There is a report by the Boston Consulting Group that suggests 10% of global GDP will be stored on blockchain by 2030.

In this post, we will discuss how we can help businesses simplify the tokenization journey with OBOL, a no-code or low-code, highly scalable, cost-effective, and easy-to-integrate tokenization platform that is architected to deploy on Amazon Web Services (AWS).

HCLTech OBOL is a tokenization platform designed for pseudo-technical or functional users. It provides business users with a rich interface where they can create and use custom tokens. OBOL also includes a marketplace where users can list and buy tokens.

Before diving deep into OBOL, it will be helpful to review some background on blockchain, asset management, and tokens.

Background

Before diving deep into OBOL, it will be helpful to review some background on blockchain, asset management, and tokens. Let’s start with asset management, which is generally referred to as the process of managing the ownership, storage, maintenance, and use of assets as a means to generate revenue.

For example, a consumer who has invested in a renewable source of energy may be eligible to own a carbon offset credit (an example of an asset) for the amount of electricity they produce or distribute. The consumer may choose to sell the credit to an enterprise that needs it to offset its carbon footprint. The management of such credit and its utilization is an example of asset management.

Traditionally, this kind of asset management is done by a centralized third-party provider as a service to the users. This introduces dependency on the centralized third party, limits transparency, and requires placing trust in them.

These challenges can be solved with the decentralized nature of blockchain-based solutions.

Tokenization and Blockchain for Asset Management

Blockchain provides the opportunity to shift trust from an individual entity to technology. It allows us to remove intermediaries and enables participants in a trade or exchange to execute the trade themselves with trust in the system for immutability.

Tokenization and blockchain together allow assets to be owned, managed, and used with trust in the history of records. Trust is achieved due to the immutable and transparent nature of blockchain.

Tokenization is the process of representing an asset as a token. It also opens asset management to new possibilities in terms of handling and use cases. One of the prime examples of using tokenization is the fractionalization of asset ownership that can be dynamically maintained.

You can see tokenization leveraged for the following use cases:

Real Estate

- The quantity of tokens defines the percentage stake in the ownership of the property. Tokens can also define rewards, royalty or rent that contribute to incentives earned in the addition to regular movement in the token price.

Art and Memorabilia

- Non-fungible tokens (NFT), which represent the provenance of ownership rights, can discourage counterfeiting.

- Even high-value art and artifacts may be considered illiquid due to limited buyers with sufficient liquidity and interest. Trading art in the form of fractional-ownership tokens (fungible tokens) can improve liquidity.

Digital Gold

- Physical gold can be difficult to secure and also doesn’t earn returns beyond the actual movement of its price.

- Digital gold tokens issued over a blockchain platform provide immutable proof of holding or ownership and also offer additional returns in terms of interest per token.

- Digital gold tokens are easy to transfer.

Green Tokens

- Carbon offsets are important for enterprises looking to reduce greenhouse gas (GHG) emissions or work towards carbon neutrality.

- Carbon offset certificates can be marred by issues like double spending and reduced trust. These can be managed with tokens issued over a blockchain platform.

- A token issued with a recorded history of applied protocols and their audit ensures increased trust in the tokens and their immutability, thus preventing double spending.

Digital Asset Ownership

- Similar to physical assets, digital assets like digital records and art also benefit from tokenization for their ownership and fractionalization.

Bonds and Equity Trading

- Bonds and private equity trading are popular use cases for blockchain-based tokens because smart contracts can automate the issuance, trading, and redemption of tokens based on programmable logic.

- Blockchain also provides immutable records at each step, so trading can happen without the involvement of third parties.

Understanding Types of Tokens

Tokens can generally be classified into these categories:

- Fungible tokens: These are tokens that are issued as a quantity, can be fractionalized, and do not have individuality—no two tokens can be differentiated. They are generally used as currency or held as fractional ownership of an otherwise costly asset. Thus, an asset represented as a token can now be issued, owned, transferred, valued, split into fractions, and traded (as a whole or in fractions) for other tokens.

- Non-fungible tokens: NFTs are tokens that are bound to an asset. Ownership of one token is not considered equivalent to holding any other token. There are also data tokens and security tokens, but for the purpose of this post, we'll focus on the process of creating fungible and non-fungible tokens.

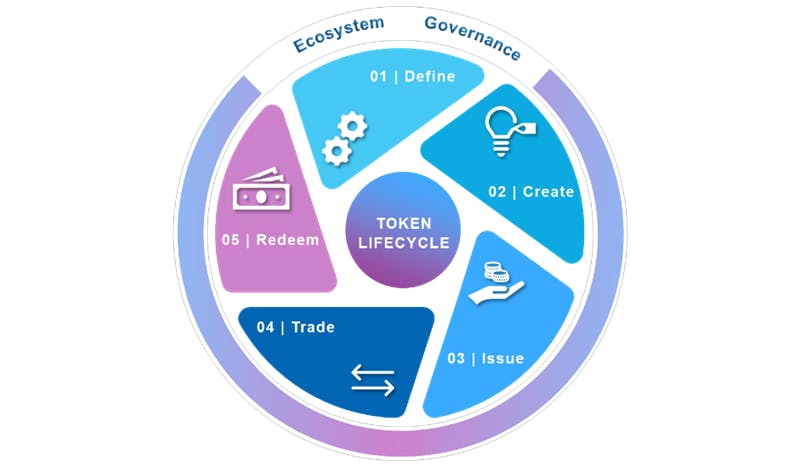

Token Lifecycle

OBOL implements the full token lifecycle in a no-code or low-code approach.

Figure 1 - Token lifecycle.

OBOL supports each lifecycle stage of tokenization as follows:

- Token definition

- To define the token template, characteristics, constraints or contracts, and workflow.

- Token creation

- To create an instance of the defined token template with the required metadata which follows the constraints and workflow defined by the template.

- This step is done once for each token instance.

- Primary token issuance

- Allow the token creator to issue the token to the primary owner of the token.

- This step is done once for each token instance.

- Secondary trading of tokens

- Allow the token owner to transfer or trade tokens (against currency tokens).

- Token redemption/burn

- Allow the token owner to transfer the token to the redemption provider as part of the redemption process.

- This process also includes the option to burn the tokens; after redemption, the tokens cannot be issued or allocated to anyone.

- Token governance

- Includes a process to share transactions with a regulator or governance authority to allow required audits, transparency, and compliance with regulations.

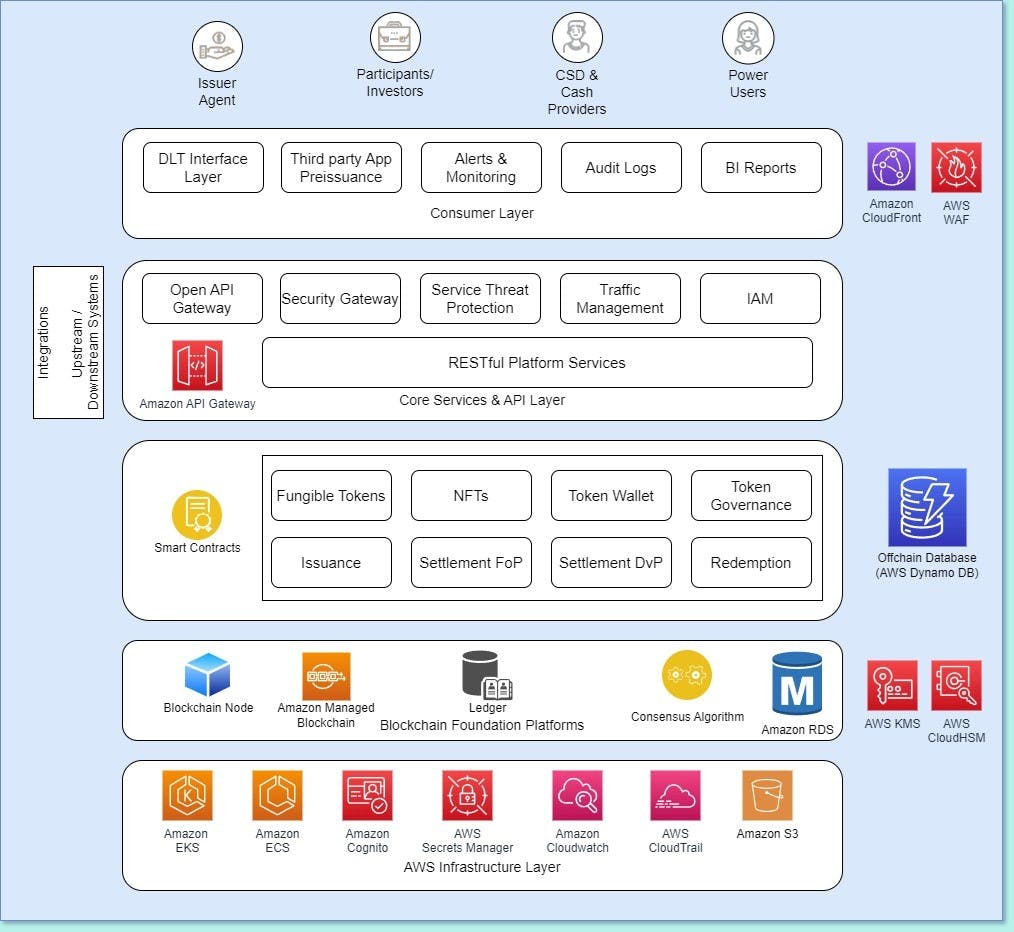

Reference Architecture

HCLTech chose AWS as its cloud platform for proven advantages such as agility, scalability, security, and resiliency. AWS allows customers to host the blockchain network and deploy the solution easily for dynamic customer needs. Figure 2 depicts the architecture of the overall OBOL tokenization platform.

Figure 2 - OBOL platform reference architecture.

Next, we'll explain different layers of the OBOL architecture using various AWS products and services.

Infrastructure Layer

The blockchain network requires low latency and scalable infrastructure that can onboard new organizations with their own nodes and ensure their availability. Amazon Elastic Kubernetes Service (Amazon EKS) provides availability and scalability with the scheduling of containers for the provisioning of new blockchain nodes and high-availability of ledgers and vaults.

This layer also includes Amazon Simple Storage Service (Amazon S3) and Amazon Elastic Block Store (Amazon EBS) to provide persistent storage and objects storage; Amazon Cognito for identity management and authorization records; Amazon Relational Database Service (Amazon RDS); Amazon DynamoDB for off-chain/configuration records; and AWS Secrets Manager to store and manage keys and certificates required for users to sign their transactions.

Distributed Ledger Technology Layer

This layer includes the blockchain network, nodes, clients, vaults, and smart contracts. It uses Amazon Managed Blockchain for Hyperledger Fabric and Ethereum, or Amazon EKS for the Corda blockchain network.

OBOL has pre-built transaction flows, chain codes, and smart contracts to allow the creation of token templates with the necessary metadata attributes. It supports primary issuance, secondary trading, and settlement for both fungible and non-fungible tokens (like ERC20 and ERC720), including platform currency that can act as a stable coin.

Core Services and API Layer

This layer has a microservices-based architecture that covers the services required to authorize, interact with, and query smart contracts. It also includes various service orchestrations before smart contracts are invoked.

These services can be hosted using different options, including Amazon Elastic Container Service (Amazon ECS) or pods in Amazon EKS, and are secured and monitored using Amazon API Gateway, which is a fully managed service that makes it easy to create, publish, maintain, monitor, and secure APIs at scale.

Presentation Layer

This layer includes interfaces that consume core services or APIs to provide access to underlying platforms using an API or web user interface. The interface follows OpenID Connect (OIDC), an open authentication protocol for authorization that is supported by Amazon Cognito. This helps link identities with OIDC providers you configure through AWS Identity and Access Management (IAM).

This layer also includes a marketplace where users can list their tokens for sale or buy the listed tokens in secondary trading.

Integration Layer

This layer uses REST (representational state transfer) services exposed by the core services layer to provide integration with pre-issuance platforms and other enterprise systems that produce or consume data.

This platform can also act as an identity and tokenization platform for metaverse use cases.

Alerts and Monitoring Layer

This layer includes systems like alerts, monitoring, audit logs, and business intelligence (BI) reports. It uses Amazon CloudWatch and AWS CloudTrail for logging and monitoring of AWS services and resources.

Implementing a Token with OBOL

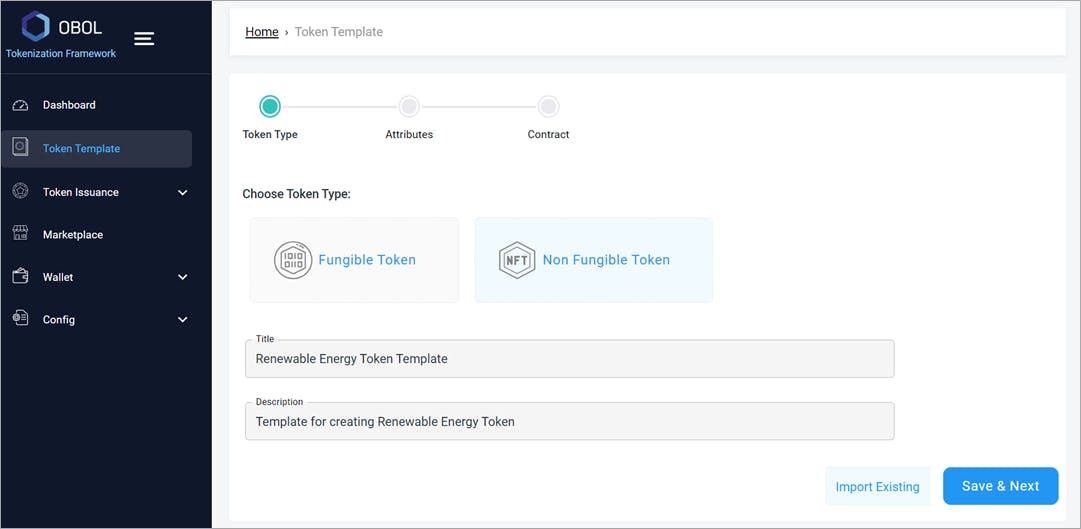

Let's understand OBOL better with an example of an ESG Token that an enterprise (called Company G) will issue to people participating in sustainability measures like investing in and utilizing renewable energy.

Tokens will be issued to multiple individuals or entities with unique information about their contributions. They will therefore need a reusable NFT template for all such tokens. We can define a new template or import and modify an existing one, as shown below.

Figure 3 - Defining token template: token type.

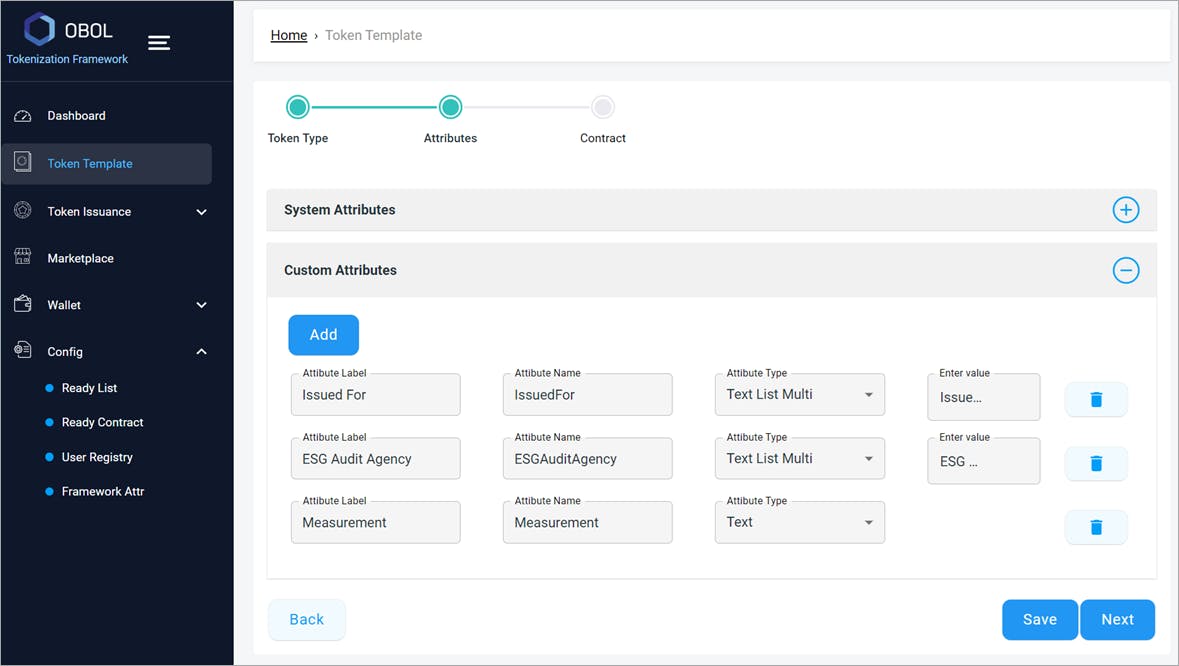

Next, we define what characteristics the token shall have. OBOL allows you to define custom attributes for your tokens.

Figure 4 - Defining token template: token attributes.

The solution allows you to create "ready lists", which can be linked to an attribute to define the list of values allowed for that attribute.

- Fixed attributes: Token type, token symbol, token description, maintainer, observer.

- Customer/user-defined attributes: Issued for (use of renewable energy, afforestation, water conservation), audited by (which agency), measurement (how much).

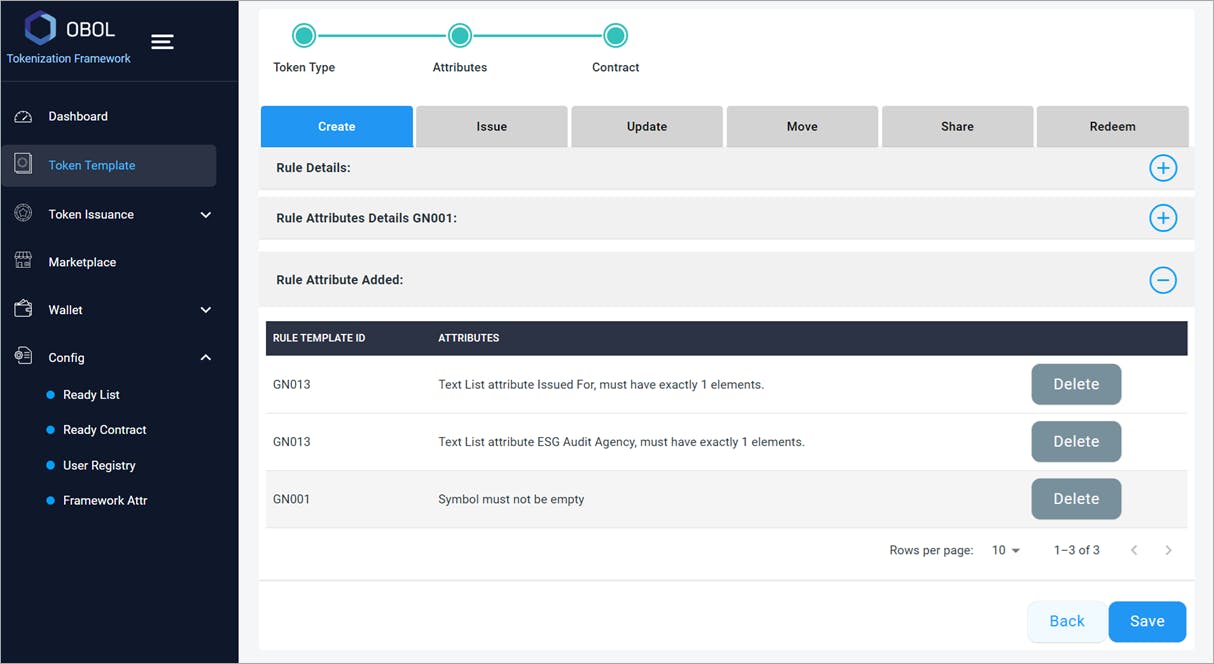

Further, OBOL enables you to associate a contract/condition/validation with different stages of a token's lifecycle.

Figure 5 - Defining token template: token contract.

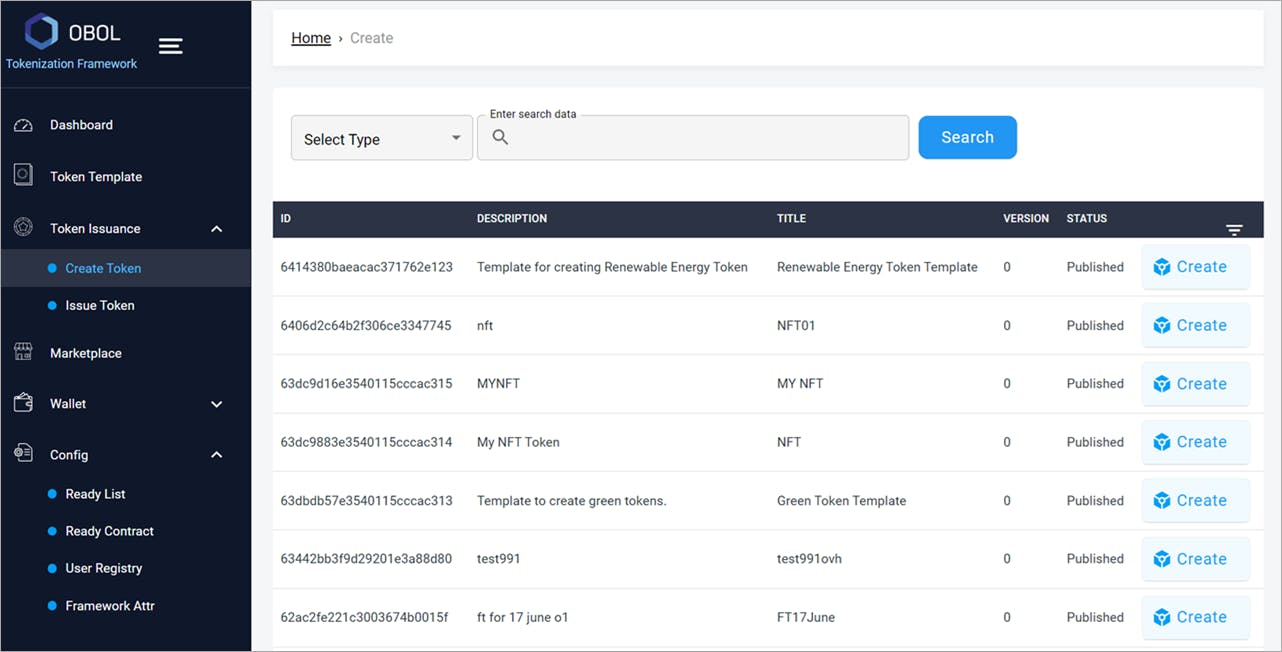

This template for "Renewable Energy Token" can now be used to create multiple NFTs.

Figure 6 - List of available token templates for token creator/issuer.

Token issuance: From the list of available templates, authorized issuers will be able to create tokens and as identified by the contract will be able to issue tokens.

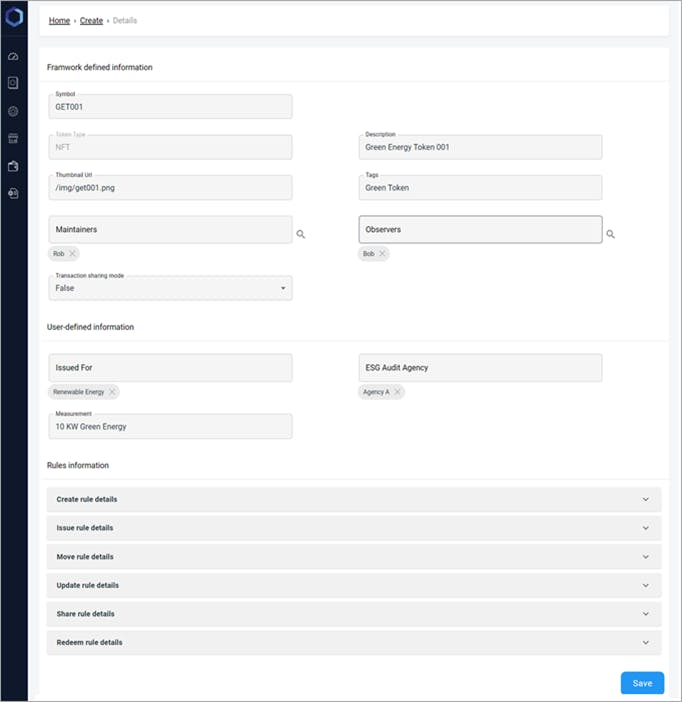

Each token (NFT) created from the template carries information specific to the individual or entity’s contribution to the renewable energy initiative. The below figure shows creation of GET001 token.

Figure 7 - Creating a token interface for token creator.

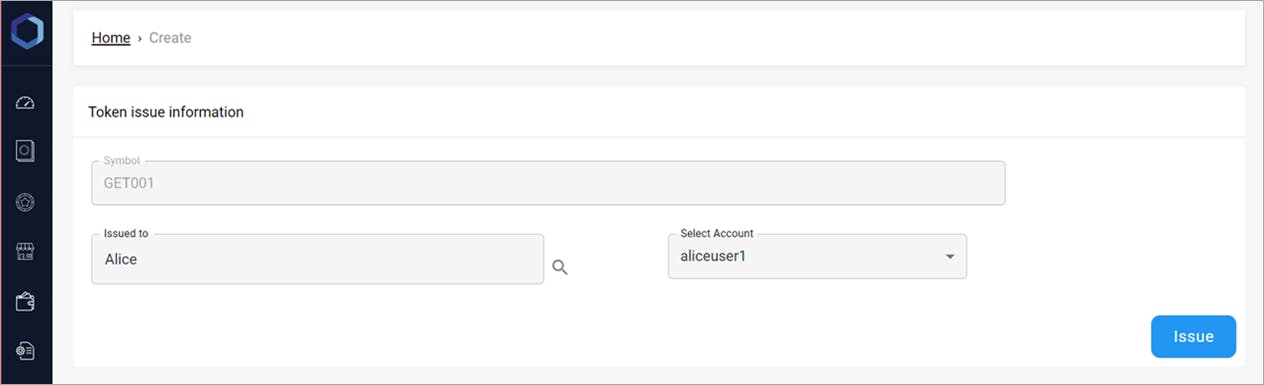

This token, once created, will become available for the maintainer/creator of the token to issue to the owner of the token on this network.

Figure 8 - Issue token interface for token issuer.

The owner receives the token in their "token wallet" and can decide to list the same on the marketplace.

- Cash wallet: Holds the cash coins/platform currency balance to settle trades (buy/sell).

- Token wallet: Fungible and non-fungible (NFT) tokens that are held by you.

Figure 9 - Token wallet for investor/user.

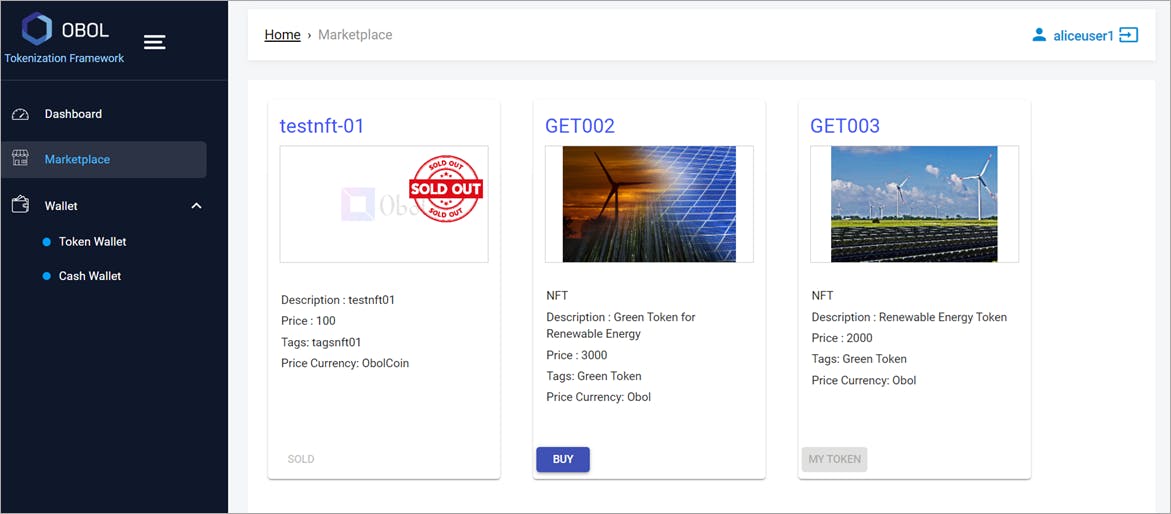

Below is the example of token after its listed for sale on the marketplace.

- Marketplace: For secondary trading or buying and listing tokens for sale.

Figure 10 - Marketplace view for investor user.

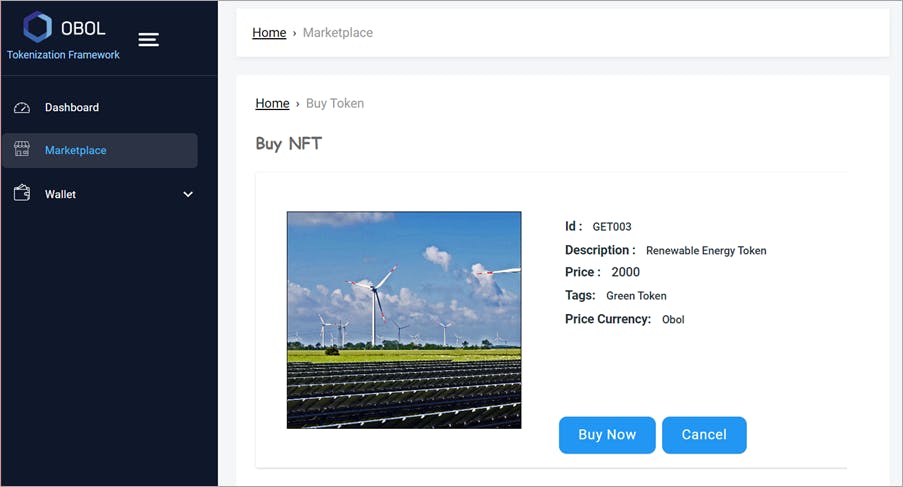

Investors can now buy the tokens for the listed price and the transaction gets settled in real time by using the currency tokens available in the buyers “cash wallet.”

Figure 11 - Marketplace view for investor user selecting to buy a token.

Conclusion

In this post, we explored HCLTech’s OBOL tokenization solution, part of the CoTrust PlatformTM. You now understand tokenization and blockchain for asset management, token types, and the token lifecycle.

We also discussed how AWS services support OBOL’s architecture and provided a use case example. With OBOL and AWS, customers can address tokenization and blockchain challenges effectively and quickly.

The CoTrust PlatformTM is a key asset that includes various solutions and accelerators to advance blockchain initiatives. It uses proven frameworks for blockchain advisory, consulting and cloud-based services, optimizing operations in industries such as financial services, shipping and logistics.

HCLTech is the first to offer blockchain solutions on cloud marketplaces. The CoTrust PlatformTM is available as SaaS for diverse industries and a PaaS version on AWS and GCP for quick and scalable blockchain implementation.

Contact HCLTech to learn more and explore OBOL and HCLTech’s blockchain capabilities through these resources: