Latest Content

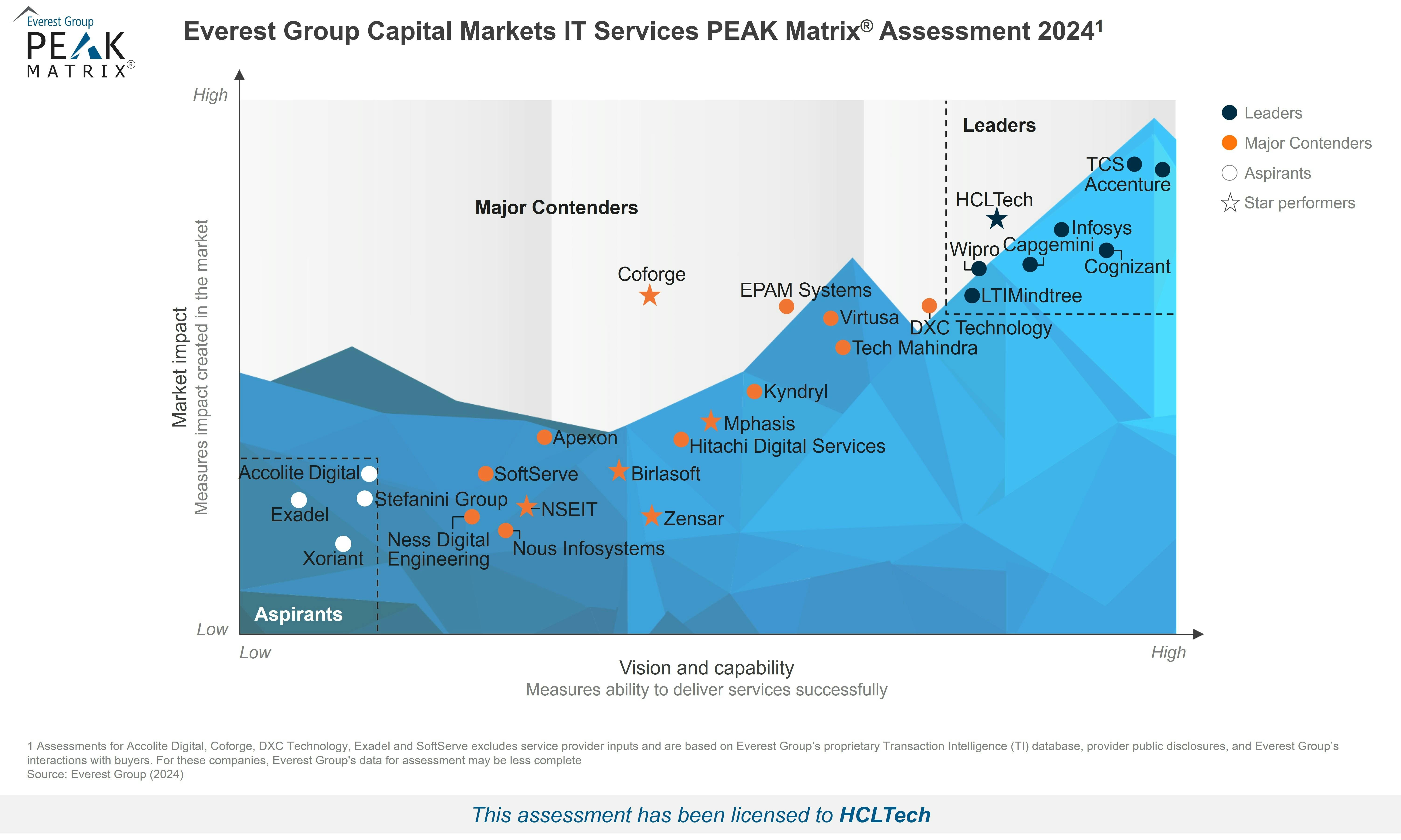

In this comprehensive study evaluating 27 leading IT services providers around the globe based on their market impact, vison and capability, HCLTech has emerged as the only Leader and Star Performer.

As per Everest Group, Leaders have a strong global presence, broader client portfolio, innovative commercial models, ability to hire and upskill the best talent in the industry, extensive thought leadership publications, and co-innovation initiatives with clients, FinTechs, and platform providers by setting up research and innovation labs.

“While HCLTech is continuing to strategically enhance its presence in asset and wealth management, investment banking, and brokerage sectors, they are also expanding in areas such as market intermediaries and custody services,” says Kriti Seth, Practice Director, Everest Group.

"Their platform-based strategy, along with strategic acquisitions such as Confinale, has bolstered their Avaloq consulting and nearshoring capabilities significantly. The integration of generative AI across diverse business areas from trade finance to trade surveillance, along with investments in key technologies such as ESG and tokenization, has also led HCLTech to earn a Leader recognition on Everest Group’s Capital Markets IT Services PEAK Matrix Assessment 2024”

Key highlights of the excerpt:

- HCLTech has a strategic focus on asset and wealth management, investment banking, and brokerages, with emerging focus on areas such as market intermediaries and custody services

- Strong platform-based strategy with proficient use of leading platforms such as Avaloq, Temenos, and Backbase enabling them to offer tailored solutions

- Acquisition of Confinale provides an increased play in Avaloq consulting, implementation, and management as well as enhanced nearshoring capabilities

- Integrating generative Al across various micro-business areas, with applications ranging from trade finance and Software Development Lifecycle (SDLC) to treasury and trade surveillance

- End-to-end coverage that caters to the comprehensive needs of capital markets such as cost reduction, digital transformation, change management, customer experience, ASM 2.0 along with a strong asset takeover play

- Investments in IP and assets in areas such as ESG, tokenization, KYC, and onboarding highlight its commitment to delivering comprehensive and forward-looking solutions

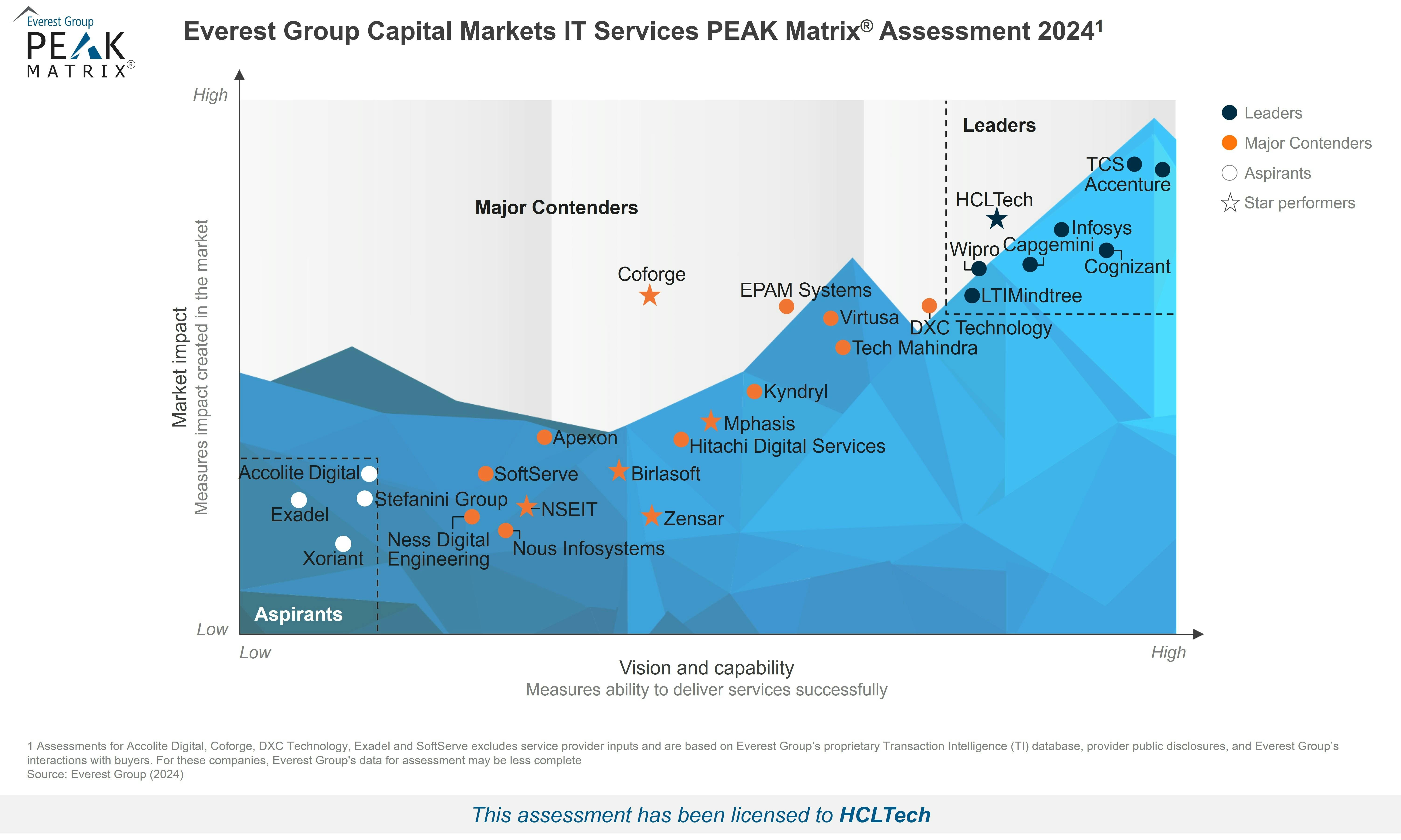

In this comprehensive study evaluating 27 leading IT services providers around the globe based on their market impact, vison and capability, HCLTech has emerged as the only Leader and Star Performer.

As per Everest Group, Leaders have a strong global presence, broader client portfolio, innovative commercial models, ability to hire and upskill the best talent in the industry, extensive thought leadership publications, and co-innovation initiatives with clients, FinTechs, and platform providers by setting up research and innovation labs.

“While HCLTech is continuing to strategically enhance its presence in asset and wealth management, investment banking, and brokerage sectors, they are also expanding in areas such as market intermediaries and custody services,” says Kriti Seth, Practice Director, Everest Group.

"Their platform-based strategy, along with strategic acquisitions such as Confinale, has bolstered their Avaloq consulting and nearshoring capabilities significantly. The integration of generative AI across diverse business areas from trade finance to trade surveillance, along with investments in key technologies such as ESG and tokenization, has also led HCLTech to earn a Leader recognition on Everest Group’s Capital Markets IT Services PEAK Matrix Assessment 2024”

Key highlights of the excerpt:

- HCLTech has a strategic focus on asset and wealth management, investment banking, and brokerages, with emerging focus on areas such as market intermediaries and custody services

- Strong platform-based strategy with proficient use of leading platforms such as Avaloq, Temenos, and Backbase enabling them to offer tailored solutions

- Acquisition of Confinale provides an increased play in Avaloq consulting, implementation, and management as well as enhanced nearshoring capabilities

- Integrating generative Al across various micro-business areas, with applications ranging from trade finance and Software Development Lifecycle (SDLC) to treasury and trade surveillance

- End-to-end coverage that caters to the comprehensive needs of capital markets such as cost reduction, digital transformation, change management, customer experience, ASM 2.0 along with a strong asset takeover play

- Investments in IP and assets in areas such as ESG, tokenization, KYC, and onboarding highlight its commitment to delivering comprehensive and forward-looking solutions