When Henry Ford introduced the assembly line in 1913, he ushered a new era for the automotive industry — the innovation ensured that an entire car could be built in just over two hours! Today, the car we drive, its body, its motor, its tires, its electronics — all of those materials are produced all around the world. The parts then travel to the car assembly point, where the car gets ready and shipped to its final destination. Logistics involved in international transactions such as getting custom clearance can often be complicated to coordinate.

While the assembly itself takes very little time, getting the car parts from different parts of the world takes about 180-days because of the manual processing involving complex paperwork, lack of transparency and siloed databases spread across different countries and contractors. The paperwork further needs to be crosschecked before the settlement, amounting in loss of time and money.

How to deal with clogs in the automotive supply chain?

So, the question is, how to create an efficient and more transparent ecosystem where you do not need much cross-checking? Well, the answer is to have an automated cross-border settlement process for Accounts Payable and Accounts Receivable (AP/AR) in the supply chain automotive industry. The adoption of blockchain and distributed ledgers ensures the entire process is digitized and made tamper-proof while reducing cycle times.

Learn how blockchain is transforming the automotive supply chain and reducing cycle time.

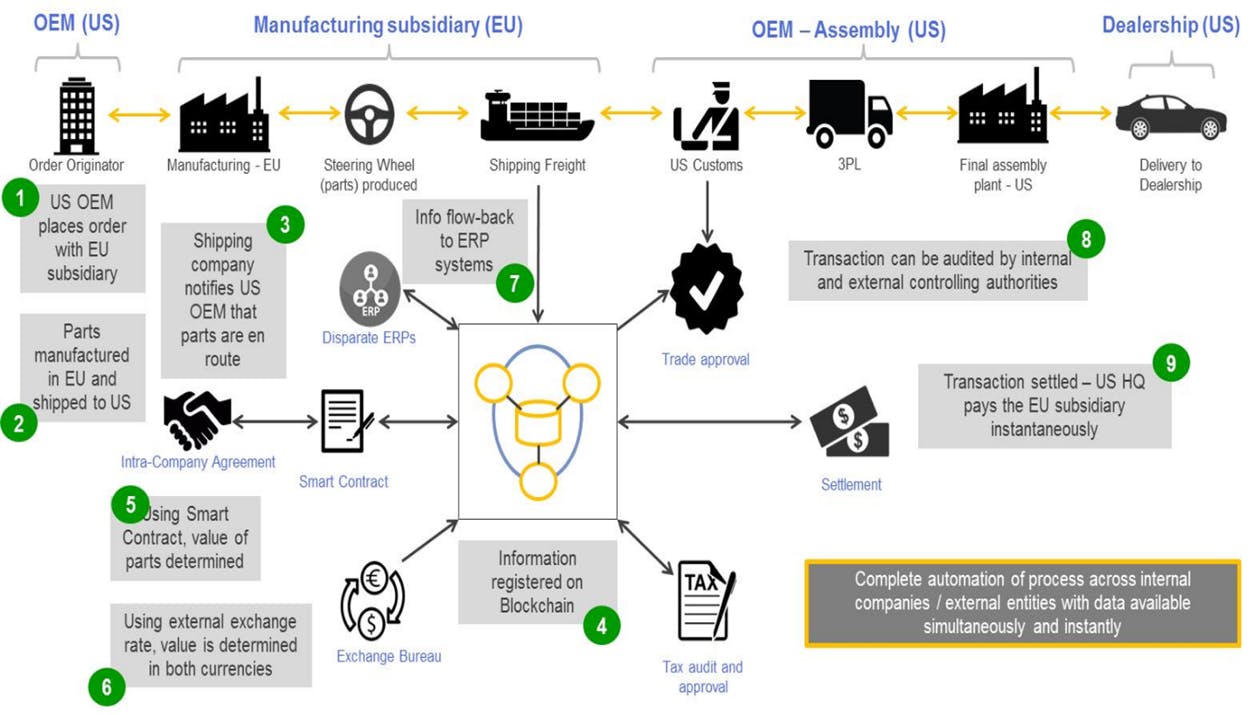

This technology eliminates the manual process, and on top of it, creates automated financial transactions and updates in the system using smart contracts at various stages. For instance, once the US customs clear a shipment using a blockchain-enabled platform, an automated AR entry is made and settled with the supplier.

The biggest benefit of having automated cross-border settlements is the reduction in cost through elimination of a lengthy settlement process.

How does the technology work?

The current process, as pointed out earlier, is very manual. It is paper-based, depends on multiple systems, and requires cross-checking before the settlement. Blockchain can revolutionize that process by enhancing automation and building a centralized data repository providing a single source of the truth. The idea is to create a ‘Permissioned Blockchain’ (blockchain with an access control layer) between cross-border business subsidiaries to automate invoice and cash settlements with automatic regulatory audit trails.

To make that happen, smart contracts are used for deriving financial values and facilitating automated cash transfers. Just like a traditional contract, a smart contract is enforceable by law. It is nothing but a digital contract with embedded security codes encompassing layers of details and permissions. However, what the blockchain technology does is, it eradicates rules, paperwork, and payment-related ambiguity concerned with the country of target. Manual paperwork is often prone to errors and delays, resulting in the material not getting invoiced.

Smart contracts automate the entire process and reduce the manual effort typically involved in gaining visibility into the settlement process. As soon as the material docks, the technology ensures that customs can use a blockchain key and get the smart ledger updated, and the liability is taken over by the original equipment manufacturer (OEM).

The process involves robust integration, which guarantees that every time local authorities make any changes to their rules, the same gets updated in the system. Moreover, the blockchain hyper-ledger can easily trace the e-documentation by scanning the smart bar code on the product in transit, thus making it easy for the OEMs to keep a tab on inventory as well as quality.

Here is how Automated Cross-border Settlement works

The benefits at a glance

While the system would ensure cost reduction for OEMs through elimination of a drawn-out settlement process, the smart contract will ensure flexibility to quickly update business rules. The blockchain would ensure enhanced security through cryptography and elimination of a single point of failure. Also, quick access to customs and other government agency records would ensure rules of the land of origin as well as those of the destination are followed and all compliance data are organized. The financial settlements, too, could be done in a jiffy as the system would ensure a single view of financial data across multiple departments and cross-border subsidiaries. Also, a ‘lack of transparency’ — the biggest factor ailing the cross-border settlement process for OEMs and their subsidiaries spread all over the world too can be dealt with. The blockchain would ensure removal of the mixture of manual, siloed systems. Disorganized data creates databases with few actionable insights. Instead, transparent transactions through shared ledgers will become the order of the day, thereby reducing the occurrence of any disputes and the need to manage the same.

The future is here!

According to MarketsandMarkets, the global blockchain supply chain market would grow at a compound annual growth rate (CAGR) of 87% and increase from $45 million in 2018 to $3,314.6 million by 2023.

The automotive industry is a complex ecosystem with multiple parties involved in the production, distribution, finance, design, marketing, selling, and servicing of vehicles. By simplifying the supply chain through automated cross-border settlements, automotive manufacturers will experience frictionless supply chains, improvements in logistics costs and lead time, faster shipping, and more straightforward supply chain paperwork and management. By providing enhanced traceability, facilitating digitization, and securing the chain-of-custody, blockchain will improve business for all global supply chain stakeholders in the automotive industry.

Blockchain is here to stay. It will not only accelerate innovation and cut frictional costs, but the technology can offer a seamless decentralized platform where information about every auto part procured from vendors across the world is accessible at the click of a button. Seamless integration with local laws of the country of origin and of destination of the shipments would ensure smooth payments. Furthermore, information related to insurance terms of the shipments, proof of its ownership, patent record (wherever necessary), and custom rules for every port can be securely recorded, tracked, and managed.

No wonder, the World Economic Forum survey report has stated that 10% of the worldwide gross domestic product (GDP) will be stored on a blockchain by 2027. It’s time we brace ourselves for a blockchain-centric future — one that will be marked by seamless supply chains, superior data security, and greater compliance.